Company Profile: Medikit

A leader in medical consumables trading at a 2.8x EBITDA (56% of market cap in cash)

Disclaimer: The content on this website is for informational and educational purposes only and is not created to meet your personal financial situation. Nothing should be considered as investment advice or as a guarantee of profit. You are advised to consult with your financial advisors to discuss your investment options and whether it would be a suitable investment for your personal needs. The information used in this publication is from sources that are believed to be reliable but the accuracy cannot be guaranteed. It may include some errors, please make sure to do your due diligence. The opinions expressed are those of the author and the author only. These opinions are subject to change without prior notice.

(Reading time: 26 minutes)

I need a bit of a SaaS break…so Made In Japan is going Medical this time! yeah I can here you saying “Shut up, Write more about SaaS!” But you know, I need to exerise my non-SaaS brain once in a while. I’ve been sitting on this for a while, but glad I did given some interesting news came out recently. Today I’m profiling a company on my watchlist, a leader in Medical consumables, Medikit (7749.JP).

Here’s a quick summary of why I found it interesting :

Medikit is a leader in safety catheters (needles) used for hemodialysis and IV

Attractive consumables with high margins (20%+)

Increasing healthcare needs driven by an aging population = growth for Medikit

Strong demand ex-Japan (US, China and EU) for it’s products particularly IV catheters, looks promising and could provide a new avenue for long term growth

Their first-ever acquisition has a device approved for marketing this year and may become a new pillar for growth targeting the Neuro industry

They expect a pipeline of new exclusive distribution agreements within Japan that should add to their existing revenue base and act as a catalyst

This quality asset looks very cheap trading at 2.8x LTM EBITDA; 0.85x P/B; cash-adjusted P/E of 5.4x

The death of the Founder may mean there could be a shakeup

Medikit has been buying back and cancelling shares in size

Medikit (Ticker: 7749.JP)

Mcap: ¥37.7b

OP Margin: 20.6%

3-Yr Sales CAGR: 4.2%

LTM P/E: 12.3x (5.4x ex-cash)

LTM EV/EBITDA: 2.8x

P/B: 0.85x

ROIC: 10.4%

Business Profile:

Founded more than 50 years ago, Medikit manufactures IV safety catheters (or IV safety needles) used for a variety of procedures. They also have a product line specifically for dialysis where they are a market leader. These safety catheters/needles used by doctors and nurses are to avoid any needlestick accidents which, as you can imagine, can be hazardous in a hospital setting. (Also, potential for a lawsuit). What’s also great about their Safety Catheters is that unlike the actual medical devices sold in Japan, it’s not subject to government reimbursement - that is, the government determines the price at which certain devices should be reimbursed for - and reviewed bi-anually. This generally becomes a headwind on prices over time.

Anyhow impact from any kind of regulatory risk is low. It is considered a consumable. (=boring, but great!)

However keep in mind Medikit does also produce intravascular catheters which are used in a surgery setting which I’ll go into detail later. Those are subject to stricter government regulation mentioned above.

Today they have 16 sales offices nationwide with a team of approximately 120 sales people. For Medikit this acts as a crucial infrastructure for product distribution as we will discuss later.

What I like is that their healthcare focus means they’ll have secular tailwinds even in Japan and they’re able to provide an increasingly useful products in an aging society where healthcare costs are exploding (upwards).

Business Divisions and Market Opportunity:

The business is segmented into three units. It’s important to understand that some of the products look similar but the market dynamics may differ. I’ll discuss the use case and the opportunity set for each.

1) Hemodialysis Catheters:

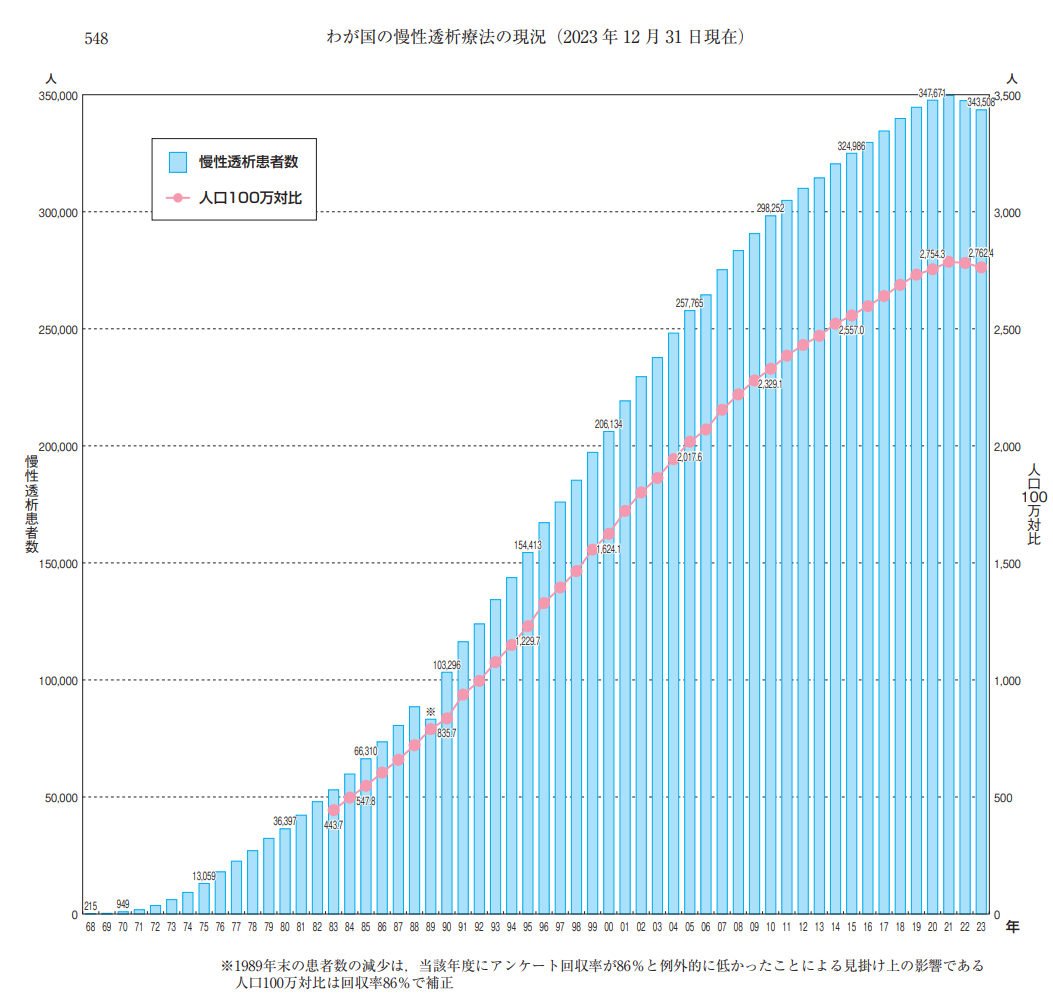

In Japan, theres an estimated 350,000 patients suffering from Chronic Kidney Disease which prevents your kidneys from functioning properly. That is, among other things, by not filtering and removing waste, and regulating your blood pressure. For such patients, a treatment is required in order to compensate for the lack of such functions. This is called dialysis and is typically required to be done 3 times a week.

In this process, the patient will be connected to a dialyzer where his/her blood is extracted, ‘cleansed’ and reintroduced in their cardiovascular system. What Medikit provides are the needles that connect the patient to the dialyzer. For this they are exclusively focused on ‘safety’ pins. One component of growth for this market is the gradual share expansion of safety needles over 'non-safety’ ones. It is estimated the penetration of safety needles is about 50% versus 20-30% only 5 years ago. There is a potential for the share to continue expanding. Note that you need a new catheter every treatment making it a consumable.

This is somewhat of a mature market and now has more or less a duopoly structure with Medikit and Covidien (now owned by Medtronic) …and some Nipro. Whilst there are some competition on pricing, Medikit continues to develop needles with better functionality and provides a range of products.

The market seems to have peaked in 2021, and the number of patients have since been flat/declined slightly. Although it’s not absolutely clear as to why, the two main factors seem to be 1) ageing demographic of Dailysis Patients and 2) increased number of deaths due to Covid. So I think the market here is pretty mature, I’d expect some growth from increasing penetration (of safety caths) + Market share of Medikit but overall not much.

2) IV safety Catheters:

Similarly we have more ‘general use’ IV Safety Catheters, which is used on patients for a variety of reasons. Today in Japan we are using around 130 million of such needles. This is still below pre-covid levels of 140 million but is steadily moving towards that baseline level and is expected to continue growing from there. Applications are wide and should expect some growth in tandem with increasing healthcare costs in Japan driven by the aging population.

In Japan, Medikit is said to have 40-45% market share of the overall IV Catheter market which includes both Safety and Non-safety ones. Specifically in the Safety Catheter Segment, Medikit is estimated to have 60-70% market share so they have a stronghold here. Safety needles already have a penetration of 70% in the IV catheter market so Medikit’s presence is substantial. Especially in a hospital setting, if you infect someone by accident this will cause all kinds of hazards, and hence why safety needles are quickly becoming a must. In this sense, it’s a pretty low-cost but critical way to minimize risks. Roughly 90% of IV Catheter sales for Medikit comes from Safety Catheters. Again for obvious reasons this is also one time use!!

Whilst this is not a super fast grower, I’d expect the market to see more growth versus Dialysis Catheters given the wide range of use cases. On the otherhand Medikit already has a dominant market share and it’s hard to see how much more they can grab. So the growth drivers are almost the oppositve of the dialysis catheters! However one big difference IMO is that there is an opportunity for growth through overseas expansion which looks promising. They are experiencing strong interest in markets such as the US, EU, China and Taiwan. (More on that later)

Competitors in this space already includes well-known medical equipment players like B.Braun, Becton Dickinson (BDX) and Terumo (4543.JP). What differentiates Medikit’s products from these major players are the compact product design which is convenient and reduces waste material. The sharpness of its needles are also highly recognized as this results in minimal trauma. So overall, given it uses less raw material per needle, and due to their high focus on this product category, the company can sell these needles abroad cheaper than their competitors. They are seeing increased interest in the European market where Medikit is quickly being recognised for product quality. In the US, Medikit’s distribution partner has been ICU medical, whom are known as one of the largest distributors for medical consumables related to IV and has also been driving growth for Medikit in the US.

3) Intervention Segment

Medikit also provides a portfolio of medical device products used in minimally invasive cardiovascular procedures. Currently, their mainstay product is Supersheath (yeah it sounds like a mystical weapon in a super hero movie) which is roughly 40% of the segment. This product is an ‘introducer’ which enables other catheters (from other makers too) to enter the vessel with less trauma. Consider it a catheter for catheters.

Other than that theres approx 30 products under this segment. For instance, Medikit sells an angiographic catheter which is said to have some meaningful market share. Furthermore, this segment also highlights somewhat of a hidden moat. This segment also distributes 3rd party products and has been able to reach exclusive distribution agreements with major foreign Medtech companies. So overseas operators also see value in Medikit’s strong sales network for specific treatment areas. Thus there is strong potential for Medikit to reaching new distribution agreements for medtech companies abroad to expand into Japan. Especially if the efficacy of such device is high, the revenue contribution potential shouldn’t be underestimated. Nonetheless, Medikit seems to see this segment as priority. They expect this segment to grow at a 10% CAGR whilst other segments much slower.

A key discinction to note from the other 2 segments is that this segments main products are subject to government reimbursement which adds some uncertainty to pricing and therefore revenue and margins. Such medical products are categorized by the Japanese Government and priced accordingly. This is reviewed every two years and typically prices are revised downwards in most cases. On the other hand price points are much higher than consumables.

Because of the nature of the products, which require government approval and acceptance by medical professionals this is certainly a high barrier to entry business. Also this requires more specialist sales personnel/infrastructure which is also not easy to build up.

Whilst they do not really break out the profitability of each segment, my understanding is that the difference is marginal. The intervention segment for example has more variance in ASP per product and more personnel are involved so margins are 1-2 % lower. This does not seem like a big difference.

Management

One thing that definitelly stood out about this business is that these guys have proven to be shareholder friendly in recent years and have been returning cash to shareholders via buybacks and dividends - before many of the other <1 P/B companies started doing it.

There was a step change with a pretty chunky sale from the founding family soon after the death of the founder in 2023. (His Family’s investment vehicle Nakajima Corporation decided to sell 2mn shares in the end of 2023, 10.59% of float) While no particular reason was given I speculate this could’ve been related to the death of the founder, which likely triggered an inheritance tax (You may recall this scenario from Mr.Kiyohara’s book!). In order to pay for it the founding family likely sold a portion of their shares to raise cash.

However, the sale was offset by Medikit buying back (again Kiyohara-san talked about this). This looks timely from a valuation perspective anyways and they also seem to be keen on better capital allocation. We can see that Medikit directly bought back 10.59% of outstanding shares and canceled 1 million shares (roughly 5.3% of shares outstanding) soon after. Furthermore they’ve incrementally bought back more share since (~2%) and cancelled another 11.19% just this February.

It’s interesting to note that Varecs (a Japanese Long Only fund with a track record of close engagement with companies) are long-time investors and increased their stake upon the sale of the family last year. Their ownership increased from 5.62% of the company to 13.05% as of Jan 2024. I think this can be seen as a positive and likely provides some guardrails in terms of how the company allocated capital. If anything this may provide further tailwinds on shareholder returns as a result (like the recent share cancellation). In any case, this feels like a pretty significant change for Medikit.

*I found Varec’s thesis on medikit on Value Investor Insight here. (from 2017)

Operationally, after the passing of the Founder, Kageyama-san the current CEO continues to run the business focusing on both sales and strategy. He has been in this position since 2021 so theres likely minimal disruption in their day to day. He’s a company man through and through and has been with Medikit since 1986! Also to be honest its probably better than the son of the founder simply taking over. In any case, even after founders ‘retiring’ they can have an outsized say in the normal course of business, so with the CEO more in control now, we could potentially see some interesting developments.

The son of the founder is a VP and heads Medikit Togo (a subsidiary) leading production and development. He has been with the firm for since 1995, and thus he seems to have a good amount of experience in the industry too! It’s likely at some point he may take over the company as CEO - when the time comes - but this is just a speculation.

MT Trajectory:

Through 03/29 the company mapped out their expectation to grow the topline by around 5.5-8.5%. Which isn’t bad. The core of it will be due to:

Growth through global expansion of IV Catheters

Global expansion via it’s intervention segment

Launch of new products domestically via the intervention segment

However, margins will initially dip due to the elevated depreciation costs from their new factories. One started operating in 06/24 and the other started in 01/25 in order to boost capacity in anticipation of growth. This seems to be why they expect OP to decline -11% for the fiscal period 03/25. Given these factories are coming online later in the year (and depreciation only accounted then) I’m assuming margins will decline a little more 03/26. From around 03/27 margins is expected to start improving again and looks to reach 18% by the end of the MT period. In other words it will require some patience as this will mean relatively ‘low’ earnings growth and will be a hit on their free cash flow. Whilst I’m not sure how much OP will decline in 03/26, from 03/25 to 03/29 this is like a 7.2% CAGR at the mid-point. Which is not great but not too bad either. (With the buyback+share cancellation on an EPS basis should also look better)

That said, over the medium term, it seems plausible that they can get back to a baseline level of profitability after an initial ‘dip’. I feel the 18% figure is somewhat conservative considering the that historically margins have been in 20%+, and I don’t think anything will be structurally too different to today especially as they want to focus on high margin products in the intervention segment - so there could be upside..

Assuming they achieve it (which given my take it’s conservative, probability feels high) the 4-year forward EBIT multiple is looking something like..3x EBIT which looks cheap considering the quality of the asset. (as in, they may actually have a portfolio of globally competitive products).

Company wants to grow overseas by 20%+ from FY23-28 driven by expansion of its IV catheters globally (with focus on the US) + expansion into China through multiple product categories. If they succeed at this, the overseas segment will become a larger portion of Medikit’s sales and could drive growth for a looooong time - given the large market.

Blue = Dialysis Cath segment

Green = IV Cath segment

Grey = Intervention segment

Upside from Potential Catalysts:

Now the products are interesting but the growth opp for this business needs reflecting on as some segments are undoubtedly mature. So the key question is whats going to change?

There are some really interesting avenues that Medikit are exploring to further bolster growth and what I think could become a core component of the thesis and catalysts for the stock. Most of these are underway but have yet to show in their numbers. There’s a few angles:

Bolt Medical: In 2022 for the first time ever, Medikit made an acquisition. Not just an acquisition but in a pre-revenue company in Bolt Medical. However the main product they have developed called Medilizer AGD (Anchor Guiding Device), a guiding catheter looks promising and is set to be released in February 2025. The product is developed for neurosurgery and allows for real time monitoring of the catheters. (which kinda reminded me of US med device company ClearPoint Neuro which I remember

wrote about recently). Not only does this device enhance safety but also speed.The issue here was that it’s been difficult to get much detail on this. Not much public information was available. According to company, it seems to already be strong support from KOLs and the company is already seeing strong interest for this product. Then there are two components that need to be considered here. Firstly, the company just recently got an indication of reimbursement price from the government. They hoped to be designated in a ‘new category’ that is not compared to any other similar products. A lack of comparables = a higher price. The company expected ¥200-300k per catheter and is now set at ¥284k. Medikit hopes to get to 8000-10,000 catheters a year in the mid-term. Taking the upper range for of this estimate the incremental annualised revenues from this could be close to ¥3 billion. They also seem to see an expansion opportunity in the US.

What’s interesting here is that it’s not going to make a massive bump on Medikit’s revenue per se. However such a “Theorectically” high functioning catheter could be valued much higher at some point. Not the biggest SOTP guy but just to give an idea the closest seeming public peer Clear Point Neuro in the US fetches close to 10x revenue multiple (although they have a massive pipeline of pharma partners so keeping that in mind!) and Japanese Catheter Champion Asahi Intecc around 5x. Based on the ¥3 billion math I laid out earlier this product alone could fetch ¥15-30bn based on these comps (I concede US comps might not be the most fair). If this comes anywhere close though… it implies this could worth as much as Medikit’s current Enterprise value roughly ¥17bn!

New product distribution agreement in Japan: Medikit could potentially announce more products to distribute on behalf of major US device manufacturers in Japan but leveraging their sales network. They’ve done this in the past Cardio Vascular System’s Diamond back 360 was one such example - but have since changed distributors. However just recently they announced a partnership with Inari Medicals’ ClotTriever. I am yet to understand what the opportunity from this product could mean but this could potentially be a very interesting opportunity. For one, it was an interesting enough product that Inari itself was acquired by Stryker just this year. Based on my very amateur understanding, this solves for Deep Vein Thrombosis - a condition with a potentially huge TAM - that can be treated via its minimally invasive catheters instead of other alternatives with potentially dangerous side effects. It’s unclear to me just how large the market could be for Japan but looking at the causes of DVT makes me believe there’s sufficient reason for Japanese people to suffer from this too. Anyhow Inari got acquired at $80 a share which if I got the math right should be like 10x LTM revenue. So this could also be an interesting opportunity for Medikit. Now I’m mindful there’s not been a set date for a full rollout but Medikit will be helping conduct a PostMarketing Surveillance (PMS) with 100 cases. (i.e. already MHLW approved - kinda like the FDA equivalent).

Any additional products in the pipeline could mean a further potential for Medikit to add new growth pillars. I don’t think this is completely unreasonable to anticipate and it’s also probably not reflected in their MT plan!

New distribution agreements overseas: While Medikit’s distributors already seems to have a wide regional coverage abroad for Medikit’s catheters they could potentially drum up new agreements for regions not yet covered. Whilst it’s also in the ‘base’ case Mid term plan - I think their existing portfolio may have significant growth opportunities abroad. Just this January they got approval to sell their Dialysis catheter “Super Cath Neo” in China through their distribution partner, which once again i’d imagine can be a big opportunity given the population. As you’ll note however not all is good - Boston Scientific terminated the global distribution agreement for Medikit’s Sheath introducer after 18 long years an that’s been a hit on the intervention segment (see below). On the bright side Asahi Intecc picked up this parntership and will be distributing for Medikit instead. Asahi is a very respectable company and has been a multi-bagger itself. That said, I don’t think coverage will be the same nor as extensive simply because I think Boston’s Global Presence is that much bigger - so there may be short term pain here.

Further buybacks/Capital returns: More stock related but despite the buybacks, Medikit’s balance sheet is still over capitalised no matter how you see it. If the company decides to improve shareholder returns, in line with the popular governance narrative in Japan, this could foster some more interest by the market. (Although so far, it hasnt lol…) The buybacks for Medikit shares have been quite big, which they seem to be doing despite the illiquidity of the company.

What I didn’t like/Risks:

Now there’s a couple risk components/uncertainties that I’m not comfortable with yet and has led me to sit on the sidelines on this one. for now.

Impact on Free Cash flow: Medikit is about to enter a phase of capacity expansion for their safety needle production given the strong demand abroad - and since they’re already operating at full capacity. This will likely eat away at their earnings/Free cash flow at in the next ~2 years. Whilst demand for such consumables are likely recession-proof, with the capacity expansion mainly aimed at overseas expansion thers a bit of uncertainty here. This leads me to the second risk which is what could happen if the Yen strengthens? for example, will the demand really be that inelastic? In such an event we could be looking at a massive price correction at local currency. Their overseas biz for better or for worse has seen a tailwind for demand due to the weaker yen. In practise it’s probably not smart to assume that the product is completely price inelastic and I’d expect some negative impact should that happen.

Growth is slow: Originally I was hoping for a somewhat faster growth potential for this business. This could happen if they are able to scale their overseas business + launch new products much better than what the company expects. Just how much better? I’m finding it hard to gain conviction. If overseas sales become a more meaningful portion, I am keen to change my mind. In a nutshell, the growth is also dependent on relatively new product groups which also puts the odds of success somewhat lower. For now, I just don’t feel the new growth opps quite moves the needle to drive any significant acceleration in any case. Considering the stock with margins expected to be weaker the next 18 months or so and investors being impatient, the stock may not move much.

Regulatory: Alot of the growth is expected to come from it’s intervention segment, an exciting product segment but also highly regulated in Japan. This includes the up coming Medilizer AGD release and the Inari’s ClotTriever. This is a wildcard risk because we don’t really know how the goverment will revise prices - which happens every two years. It’s not been uncommon for med devices to have their reimbursement prices marked down double digit % in a single review so this is something I’d certainly watch for. It’s also something that’ll be difficult to model, not just for investors but also for the companies themselves. My Medilizer AGD revenue assumption earlier did not take into account any of the revisions and in the end may come in lower. (Perhaps, this could also be a good reason to deserve a lower sales multiple versus comps, given it’ll be mainly sold in Japan, where the price is regulated).

Commoditization risk: The ‘non-safety’catheters (So just catheters, lol) which are cheaper and less functional (i.e. more prone to safety hazards) have seen some commoditization occur whereby there is a larger emphasis on price. Whilst the ‘safety’ component is quite crucial, I don’t think it’s responsible to completely rule out this as a potential risk and eventuality. This is especially the case for Dialysis Catheters abroad where overseas players sell for very cheap and the market seems to be okay wth it. That said, in Japan the market for Dialysis Caths are oligopolistic with just Medikit, Covidien and Nipro being the main ones so full on price wars seems unlikely. For IV caths Medikit’s price is already lower than that of foreign players it seems.

Distribution agreements being cancelled: One thing that did not look good optically was the cancellation of two distribution agreements over the course of 2 years as I touched upon earlier. One was the exclusive agreement for Medikit to distribute Diamondback 360 in Japan for Cardio Vascular Soutions, the other was with Boston Scientific for the distribution of Medikit intervention product (sheath introducer). I’m sure they’ve had their reasons but more such terminations may impede medikit from achieving their goals.

Poor English Disclosure: This is the typical JapanCo that has minimal english disclosure. Though this is also an opporutnity. Should they be able to attract a wider audience of investors not only in Japan but abroad, that diversity of shareholder base could provide some liquidity in the stock. Oh yeah, I almost forgot, but low liquidity is also an issue. But I think international investors getting more clear information on this company could lead to a more appropriate valuation. Although it seems like some funds have already managed to find it interesting enough to hold it!

Valuation

From a valuation perspective, I think this business is quite plainly cheap. This is a medical precision consumable used in a pretty critical medical setting, trading at 3.5x EBIT. So the downside feels very limited (though things can get worse in the short term of course… as can be seen by the recent price movements) and conversely an asymmetric opportunity.

It’s quite hard to find a pureplay peer to Medikit, as many tend to be divisions of larger medtech/med device majors.

Although not quite the same, the most comparable public Japanese peer would be something like a Mani (7730.JP) which makes eyeless needles used in surgical settings (i.e. also a consumable). Admittedly, this is growing faster than Medikit in recent years but valued at 14x EBIT which is significantly higher. I’ve also mentioned Clearpoint earlier specifically for the neuro component.

Some clear reasons:

Medikit has gotten ridiculously illiquid i.e. uninvestible for many

Growth is also slower compared to Mani (though margins around the same)

Others have more global presence

The flipside is that should they expand globally (and thus their TAM becoming larger) could they re-rate?

and with the spate of M&A transactions in Japan, it also begs the question, if they were to be acquired, how much will this be acquired for? For a Medical Device/equipment supplier this could certainly be highly complementary for their product portfolio. For one, I’d be quite surprised if this gets acquired at the current price stage of 2.8x EBITDA/0.85x Price/Book… Although the likelihood of M&A seems low for now as the family still owns a meaningful amount of shares.

Management seems to agree on valuation at least, as they’ve been buying back shares and cancelling them like no tomorrow.

Conclusion

In a nutshell I like to see both strong earnings growth potential + re-rating potential in businesses. I think this has the latter in spades. However the former, I’m less certain. Hence why I’ve been sitting on the sidelines for now. Having said that writing this made me want to pull a few of the strings I mentioned so thanks for that! (If you have any insights on Inari, please feel free to message me!)

You can potentially draw some parallels to Japanese MedTech leaders like Mani, Terumo or Asahi Intecc which have all done relatively well through their highly globally competitive products. These are also valued way higher. There are some overlaps in products and in some cases are also partners as you saw earlier. So you can see a potential for this delta to narrow.

Despite my reluctance, I do think this is quite an attractive business. A true ‘Made in Japan’ product that’s appreciated by customers based on that very philosophy - high function, high quality. I just feel we might be a little too early. Expenses are to go up and profit growth to slow temporarily. If it was just that I’m in principle OK given I’m trying to look out for a few years. However, for some of the new growth opportunities I couldn’t find enough data and the change in distributors is something that I couldn’t quite get comfortable at the moment. We can assume the new distribution partnership with Asahi will likely lead to some initial loss of customers but I’m just not quite sure how much (Though this seems to be modelled in the MT plan). Mind you alot of this is already in the companies expectations but I’m struggling to find the info that makes me think it’ll do better than what the company says.

I think the acquisition of Bolt Medical or its agreement with Inari Medical could be a really interesting kicker to growth/earnings and could be a huge catalyst. But based on my maths at least, I don’t think Bolt alone will be enough to move the needles for them but still good for the business nonetheless. (unless a higher revenue multiple is attributed do this ofc!) There is also the real potential that as their intervention segment grows through new launches like this and becomes a larger portion of revenues, they could be rewarded with a higher valuation multiple as an actual ‘medical device’ i.e. a business with higher regulatory barriers to entry and faster growing albeit the heavier regulations. So the huge re-rating potential is certainly there not only because of the ‘med-device’ transform but also ‘global player’ status. However again it feels it’s still a few years out and the distribution of outcomes feels a little too wide at the current stage.

But this would be the main thesis for Medikit IMO. Which is that this company trading at 0.8x book, single-digit cashflow, may have a potentially massive kicker through its distribution agreements + product launches to transform into a global medical equipment company.

I also want to balance the fact that Medikit also seem pretty conservative in their targets given the uncertainty in some of the product launches, so that may already be priced in. They also seem to be in good hands with investors like Varecs.

Overall I’m stewing over this one, perhaps it may be a good one to hold with a ‘basket’ approach….

That’ll be all from me today. As always, thanks again for your time, would love to hear your thoughts!

Disclaimer: The content on this website is for informational and educational purposes only and is not created to meet your personal financial situation. Nothing should be considered as investment advice or as a guarantee of profit. You are advised to consult with your financial advisors to discuss your investment options and whether it would be a suitable investment for your personal needs. The information used in this publication is from sources that are believed to be reliable but the accuracy cannot be guaranteed. It may include some errors, please make sure to do your due diligence. The opinions expressed are those of the author and the author only. These opinions are subject to change without prior notice.

Thanks - look forward to this. Quick scan shows me that Dalton were in this in 2023, though I can't see if they still are.

Great write-up as always, Made in Japan, and thanks for flagging me.

I just finished reading this post... and found a news article that Boston Scientific is acquiring Bolt Medical, Inc...

"MARLBOROUGH, Mass., Jan. 8, 2025 /PRNewswire/ -- Boston Scientific Corporation (NYSE: BSX) today announced it has entered into a definitive agreement to acquire Bolt Medical, Inc., the developer of an intravascular lithotripsy (IVL) advanced laser-based platform for the treatment of coronary and peripheral artery disease."

https://news.bostonscientific.com/2025-01-08-Boston-Scientific-Announces-Agreement-to-Acquire-Bolt-Medical,-Inc

Is that the same Bolt Medical as in your post? If not, do you know how these businesses are related?