Some updated thoughts on previous ideas ($)

and what I'm doing with them to start off the year...

Disclaimer: The content on this website is for informational and educational purposes only and is not created to meet your personal financial situation. Nothing should be considered as investment advice or as a guarantee of profit. You are advised to consult with your financial advisors to discuss your investment options and whether it would be a suitable investment for your personal needs. The information used in this publication is from sources that are believed to be reliable but the accuracy cannot be guaranteed. It may include some errors, please make sure to do your due diligence. The opinions expressed are those of the author and the author only. These opinions are subject to change without prior notice.

Disclosure: The author currently owns shares of the companies mentioned as of 3 January 2025. The security could be sold at any point in time without prior notice.

Hey everyone, first of all wishing you a very happy new year!

I hope this year brings what you’re seeking for - and I’m looking forward to more fun insightful discussions with everyone. This is the year of the Snake in Japan, which broadly signifies growth and rebirth - which hopefully becomes a great way to describe Japan! (and hopefully growth stocks also do good lol)

Today, I wanted to share my quick thoughts about 3 names that I’ve previously discussed in the past which (I feel) is worth discussing now with earnings out and as we enter 2025. I’ll also talk about what I’m doing with them.

Todays post is a short one discussing:

- - - - - - - - - - - - - - - - - ($ the paid realm $) - - - - - - - - - - - - - - - - - - -

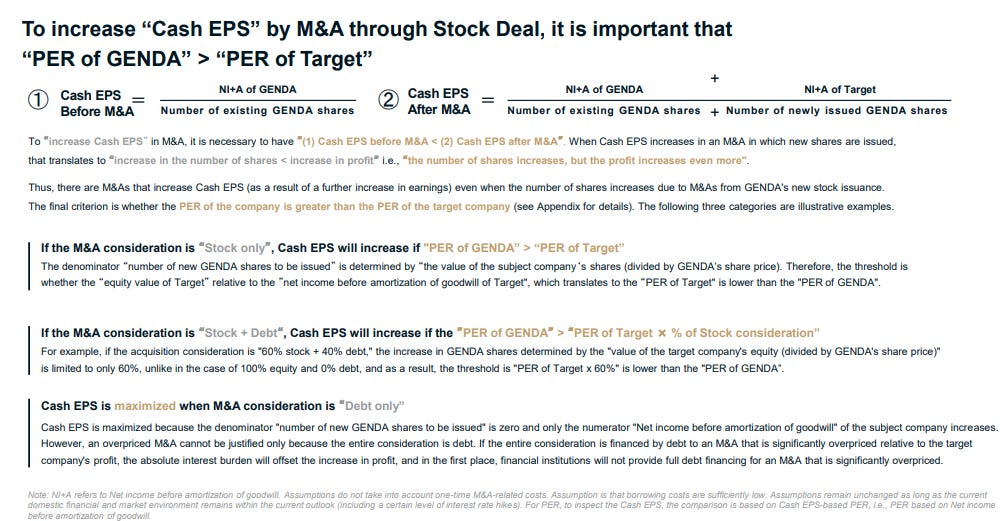

Genda ($9166.JP)

Continues to execute M&A stategy and solid integration leads to guidance upgrade, followed by a second one after closing 2 new acquisitions in HALOS and Smart Exchange

Debt levels still very modest despite the spate of acquisitions, expecting further upside as M&A opp remains ample and there is room to lever up

Overall PMI, NEN acquisition upside not considered. Valuation looks attractive

Genda so far has been an exemplary roll-up operation in Japan. While I had some doubts back in 2023 as an umproven M&A operation, I am quite impressed in the way they’ve acquired, executed and communicated to shareholders. In the year they’ve been able to onboard major international institutions as shareholders - which is something that leads to a re-rating or a more appropriate valuation of the stock. (The trick of course, is to invest in them before they do - easier said than done) They recently announced 2 new acquisition in HALOS garden and Smart Exchange which will be consolidated in March 2025.

In terms of these two deals, HALOS is broadly in line with Genda’s acquisition strategy - given the acquisition is basically to expand Genda’s store footprint. Though they do not disclose the acquisition price for this. (We can try and estimate this once they provide the updated figure of the Debt Balance, since we know how much they paid for Smart Exchange).

As for SmartExchange, it’s a bit more of a weird one. These are also unmanned machines, except they dispense ¥ in exchange for foreign currencies. Genda argues the rationale that this also helps capture further monetization from inbound tourism - which often visit arcades as part of a quintessentially Japanese Experience. (Literally every visitor I have welcomed has gone to GiGo) So this makes sense.

It’s also an absolute money maker - growing 95% in 2024 and EBITDA margins were 63%. EBITDA to FCF is also higher versus an arcade at 70%! A new installation can expect a payback period of 1.4 years which is simply very impressive.

So in more ways than one, this thing really prints money (first dad joke of the year…). I can see why this could be a good way to catch the tailwinds in the cross section of Anime and Tourism. Although not all arcade locations will have heavy tourist traffic so it makes sense they will only place these in locations where there is. However they not only look to place these in arcades though and are in discussions with a major convenience store chain, which could also be huge.

Now heres what I feel is the caveat. Back in late 2023 I remember trying to use one of them as I had some spare USD to change. As a self respecting stock degenerate Investor, I was quite shocked how bad the exchange rates were. I haven’t needed one since and don’t know how fair exchange rates are today but this is something to consider. If the machines decrease the take rates, this could lead to slightly longer payback periods and lower margins. Having said that the company acquired this for 4.7x EBITDA and 8.7x P/E financed by 70% shares (at a significant premium) and 30% in cash so the absolute downside doesn’t seem too high - especially given the strong growth. Another way to look at it is that these machines can partially justify its exchange rates for the convenience it provides (proxmity to place you want to use it).

In terms of IR, I believe Genda is in a class of its own compared to all the other companies I’ve looked at in Japan. Truly from how they explain cash earnings to even doing a monthly FAQ - I have never seen anything quite like it from a Japanese Company.

M&A is inherently harder to model but here’s my napkin math and how I think about valuation:

Based on Genda’s December Guidance upgrade, this implies an FY01/2026 EV/EBITDA of 11x on now additional M&A. Now given EBITDA to FCF conversion is roughly 50% we can say the FCF yield is about 5%. I think there is upside to this figure given that the guidance does not assume any further organic growth nor M&A which seems wildly unrealistic. I think there are multiple levers that could be pulled that will make these figures much higher.

Further levering through additional cheap M&A

NEN acquisition synergies

Incremental Margin Opportunity from PMI and self developed crane games.

So firstly, I think Genda’s leverage is still modest. At Q3 it was at a Net Debt/EBITDA of 1.3x (Pro-forma post NEN/Ontsu Closing) and with the recent acquisitions I’m esimating roughly 1.5x. I’m amazed how low it still is but I think it goes to show how low a multiple they pay on acquisitions and how cash generative many of them are. Whilst the company does not have a hard cap on debt levels I think there is more room for the co to lever up and acquire, meaning that incremental FCF can accrue to shareholders by taking on a bit more debt. They have indicated 3x is kind of the top end but not really a hard commitment.

There is also the big fish. I think there is a good chance Genda takes over one of the top 4 players. This has been something they seemed to be hoping for and the Chairman is well known in the industry which puts the odds in their favour.

Secondly, with NEN finally closing although maybe not FY01/2026 per se, I think the integration can potentially lead to meaningful upside to the figures once the synergies are realised. As I have said before, my intial expectation of per store sales increase using Genda’s Prizes would lead to a 1.5x sales uplift in existing NEN locations. However based on company comments the uplift could be significantly higher than that. In fact the overseas opportunity is overlooked for now, they recently entered Europe and remains to be seen if this can become another opportunity.

Finally, I think there is some upside from PMI and through their own self developed crane games. PMI so far has been good on average and has lead to strong revenue acceleration and profitability from acquired companies. Whilst it would be interesting to see which acquisition didn’t do as well - it seems at the group level outcomes were solid. Should this continue there could be further upside versus expectations. Something more tangible is that genda developed it’s own Crane Game machines. In-housing such a critical component I understood should help control costs as well. I guess it also depends on how quickly they want to roll this out - but should lead to some margin uplift over the medium term.

Now with that said, I am comfortably holding whilst I have not bought more. This is because I’ve also bought stock in a similar but cheaper play in Japan which I shared to my paid subscribers here ($). It is more illiquid but i feel the downside is also quantifiable, which is somewhat harder to do for Genda. Whilst I am bullish Anime IP, I’m also not trying to over expose myself to just game arcades!

If you haven’t listened to it yet my friend Jake Barfield of Ashville Capital interviewed the CFO on his podcast Quality Investing here. Highly recommend it. (No surprise but the CFO speaks English Fluently!)

I do want to offer a psychological caveat to this writing: I have been invested in Genda since November 2023 (catching the bottom was dumb luck) so I am well in the money, which makes me possibly psychologically more ‘comfortable’ to hold it. Of course I try to be vigilant with the emerging risks for this name and I try to point them out when I can, that said this could create some blind spots. The name may be still new to some of my readers and in anycase regardless of whether you own it or now please make sure to do your own due diligence!