Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclosure: The author currently owns shares in the company as of 8 April 2024. The security could be sold at any point in time without prior notice.

The question I’ll try to answer today is how appropriate is it to value a growing industrial B2B platform with substantial moats and sticky customers, for 10x P/E today? (let alone a micro-cap?) For comparison in the US think WW Grainger.

The company of concern is Alpha Purchase - Ticker: 7115

(I know, presumptuous right?)

Market Cap: 10.6 billion yen

3-year revenue CAGR: 17%

P/E: 13x (10x cash adjusted)

EBIT: 6.7x

ROCE: 17%

Summary:

Alpha Purchase is valued at 13x P/E today and 10x on a cash-adjusted basis (both on fully diluted EPS) and what I believe are on depressed earnings. This has substantial moats, growing mid-teens, and enjoys the dynamics of a distributor ala WW Grainger (GWW) but without the capital intensity or inventory risk. The forward multiples it would trade in a few years imply no growth beyond that, which I doubt and it’s also valued at a huge discount to comps. Investors seem to disregard this underfollowed microcap because of its low margins but forget about its high ROCE and ROE. I think you can get a 25% IRR with modest assumptions.

Management communicated to the market flat profit growth this year to spin off its reno division and to launch a new module which is a temporary hit on margins, but looking beyond, profits should get back on track. Revenue is forecasted to grow ‘only’ 10% this year as they focus on onboarding a large global client that comes online in 2025 that could add a good chunk of stable revenue stream. The new modules should also drive strong growth from existing customers. While still new as a public company they’ve so far tended to be very conservative on what they promise, and I think they’ll exceed expectations again.

Looking further out, with an ERP Upgrade cycle upcoming in 2027 as SAP 6.0 reaches EOS (which many Japanese industrials use) this gives them a window of opportunity to go after prospects to adopt their solution which could accelerate market share gains. Alpha Purchase is investing heavily in growth as they should, but once they reach close to 100 bil in turnover, margins could double. I think it’s a real possibility that they can achieve this in 5-6 years, which if so, combined with teens revenue growth can drive >25% earnings growth. There are so far no “hard” catalysts in the immediate future, but with strong industry tailwinds and a long runway, if this business becomes anything like a monotaRO this could become a multi-bagger for the patient investor.

Ok, so, the business

Alpha Purchase, I’ll call it AP for short, was originally started by a US Private Equity shop Ripplewood (lol, so much for made in Japan), realizing that a WW Grainger equivalent hadn’t existed yet in Japan. It was sold to Askul in 2010 when Ripplewood exited Japan.

AP’s main solution is called APMRO an enterprise procurement platform for Maintenance, Repair, and Operations items (MRO). The customers they target are very large enterprises usually with sales of over 100 billion yen. What’s great about this is that MRO demand is stable through cycles. Revenues were steady during 2008 and Covid. Below are examples of products you can buy.

Sales trend since founding…

Note that they’re not a simple distributor model and is unique – as a small upstart 23 years ago, they had major resource constraints which forced a bit of creativity, and the company had to pursue a capital-light model. On one hand, AP is still distributor-like – the product is sold through them. Revenues, therefore are booked on a GMV basis. On the other hand, suppliers bear most of the inventory risk and the logistical costs. Whenever an enterprise client orders products through APMRO, its sent directly from the supplier to the customer. So they benefit from distributor-like dynamics while staying capital light.

Why do enterprises need a solution like this?

Purchase decisions were often siloed across departments and subsidiaries but can now be centralized through a single window. This lets organizations compare prices, negotiate, and improve governance & visibility. Dai Nippon Printing came out with a press release saying after implementing APMRO it’s reduced the number of required steps by 90% so the efficiency gains can be significant. It’s said that MRO purchases only represent 3% of dollar value but account for 30% of volume. This takes a lot of wasted labor hours which can’t be rationalized in a time where we’re facing a labor shortage. HQ can now have a single overview of their MRO spend.

They also have a Facility management division -FM- a newer segment that takes the same principle but geared towards retail chain operators with large store footprints. Here, they are the one-stop shop for procuring products and services during the full store lifecycle from new store opening, maintenance, and renovation. For new store openings and renovations, the company can handle the procurement of building materials for the entire group, nationwide. This is valuable for chains because procurement is normally handled separately by regional construction companies which lack scale and can’t realize much bargaining power. They also have a nationwide partner network of maintenance companies which can be requested any time for store upkeep.

Their main customers are also enterprises here and revenues depend on 5-6 chains. Mainly majors like McDonald Japan, Lawson, Duskin, and APA Hotel.

This is also a sizable business, but for today I’ll mainly focus on the MRO division.

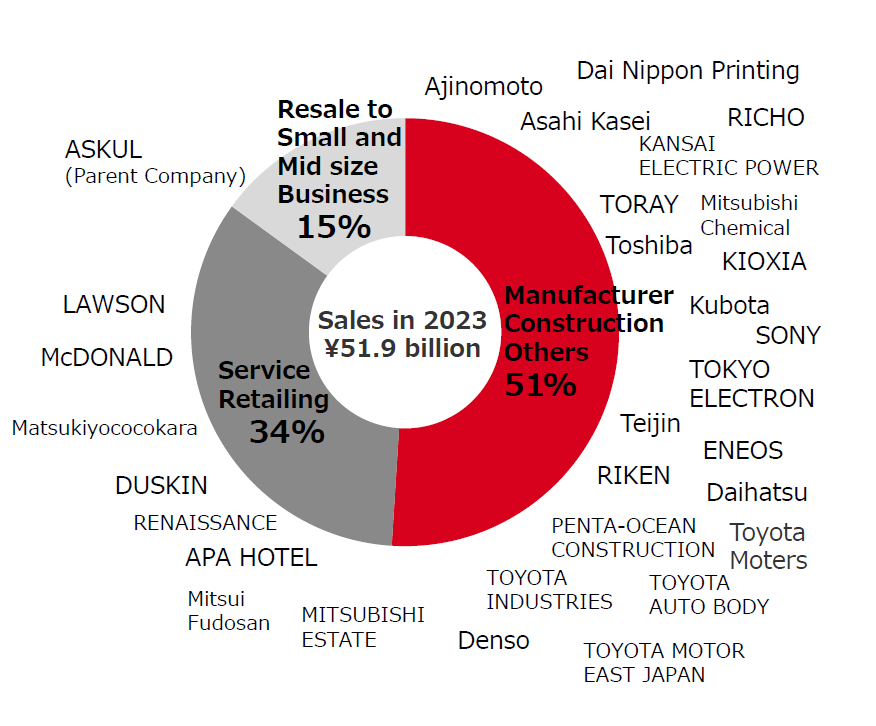

Alpha Purchase Customers:

Sizing the opportunity

For APMRO, the core market is an enterprise which they define as those with sales larger than 100 billion yen. 706 enterprises are of this scale in Japan today (and 79 are customers).

The estimated immediate TAM is around 400 billion yen for standardized products. (for context their APMRO sales are about 37 billion now). This has the potential to expand and reach closer to 1 trillion. Right now the company doesn’t account for high-value items where customers usually require a quote or customization from suppliers. AP is adding a new module so suppliers can negotiate with customers directly on APMRO. This is already in the works and will be available for beta this summer.

The FM business is different. The market for convenience stores, drugstores, and business hotels is about 27 trillion JPY combined – of this 2% of it usually is spent on renovation so their TAM is said to be 500 billion yen.

However, the actual TAM is probably smaller because customers prefer exclusivity. Convenience stores for instance must share their sensitive store expansion plans with AP – if they are working with another competitor this puts them in a tricky situation. That said, their current turnover stands at 15 billion so even if the real addressable market is less than half of this there’s still plenty to grow into. Similar to APMRO there’s also the potential for this addressable market to expand as they add new offerings and expand into other verticals.

Overall, there’s still an unbelievable amount of inefficient manual processes in an industrial setting, so plenty of ways AP can help customers operate more efficiently.

..and they have multiple growth levers to pull for APMRO:

Onboarding new customers – they onboard only 2 to 3 a year since they’re so large. The lead time can be anywhere between 6 months to 3 years depending on size. This on the other hand provides them with some visibility. It also seems that they have a pretty rich pipeline of clients. I think we can potentially see strong revenue contribution from a large client in 2025.

Increasing average spend per customer - Once an enterprise customer starts, more group subsidiaries become AP’s clients each year providing a steady level of growth. AP estimates its current wallet share to be around 50% which keeps growing by 10% a year.

Expand offerings and services - AP offers an ever-increasing number of goods and services on their platform. For example, they’ll be providing a beta solution for suppliers to negotiate/tender offers to customers this summer which should also lead to higher-value items being purchased through the platform. Increasing their addressable wallet size (read = TAM) and average order value (AOV). Still early but if this works, the opportunity will be huge.

For FM growth will come from 5-6 main clients’ renovation/capex plans. Most of AP’s revenue trickles down from their client’s maintenance capex and should provide some stability. About a third of this division is for large-scale renos which adds some swings. The company thinks FM will grow at 10% a year on average with some ups and downs. There is a continuous pipeline of stores that need renovations and maintenance. Chains are also spending more on omnichannel-driven store formats which should also help drive more renovation spending going forward. This is something I hope to share more as I find more data.

AP has a multi-layered moat

What I like about this business, having had to cut its teeth for a long time is that they’ve already built several moats at an early stage of the business life cycle. I’ll highlight the main ones.

Network Effects: APMRO has >3000 suppliers totaling 60 million SKUs provided to a customer base of 79 Enterprise groups. These groups have subsidiaries (around 30 on average). Typically there are thousands of individual users per enterprise. This might still sound like the demand side of the network is concentrated but another strength makes this network hard to dissipate which is….

High Switching Costs: implementation at an enterprise level is highly complex. Each has its own ERP modules and AP will integrate with their customer’s system in the best way possible i.e. not a turn-key solution. I want to emphasize how complex the needs of an enterprise is (especially in Japan!) making the churn of customers after integrating close to 0%. (There are some exceptions where the customer uses this module alongside other suppliers, but this makes APMRO value proposition less attractive but only accounts for 0.5% of sales.)

Data Moat: On APMRO, customers can compare prices for the same products from different suppliers, this is not easy to do because each supplier usually adheres to different product coding systems for the same product. AP has built a database so that the Product ID is unified across all suppliers. APMRO continuously works to ensure that customers can compare prices of the same product from the widest range possible from any supplier.

Customer referrals: AP mentions that new enterprises have approached them through referrals of existing clients. They only started focusing on building an outbound sales team 2 years ago. AP is trusted by enterprises with more than 1 trillion in annual revenues and for those, having referral customers is a pre-requisite during an RFP. This provides 1) strong credibility and 2) cost-efficient marketing.

Economies of scale: This is an emerging moat, as the purchase is made through AP, the order value can be quite big as it grows, this triggers some powerful collective bargaining. It’s good to have close to 80 enterprise customers fuel your purchasing.

… and most importantly I think these moats can widen as they scale, creating a positive feedback loop.

(For its FM biz they have a partner network of 1600 maintenance companies that can provide nationwide coverage. They also have specific know-how into each customer’s expansion & maintenance process – making it inconvenient for customers to replace them.)

Management

I think the management team is pretty good but this might get the most scrutiny from investors given they don’t own many shares. With the risk of me rationalizing let me explain… The CEO has been with AP since the early days. He isn’t the founder but he’s been running it as CEO from 2006 and brought the business to where it is today. He’s got some experience working in Japan and the US and is MIT-educated with an MBA.

The issue is that he only owns 1.2% of stock which isn’t much and the rest of the team don’t own much either. He and the team do have quite a bit of unvested stock options which amount to 7.8% of shares-outstanding. It’s not ideal but still, some incentive to succeed. The hurdle to exercise them is quite high. A majority of the options have a strike price of 885 yen.

Maybe they should just buy shares if they think it’s cheap, but it’s not like these guys are paying themselves much of a salary either. Japanese companies are exempt from disclosing individual remuneration unless it’s above 100 mil yen. You can see that their top 2 executives are paid 69 mil yen combined. That’s like… $230,000 per person!

The CFO was previously at Renesas, a listed semiconductor major. His experience with institutional investors (including foreign ones) has given him a strong understanding of expectation management. In a presentation to individual investors, he talks about the dangers of missing guidance as a public company. So when projecting targets for the year they come up with a wide range of outcomes and guides for the lowest end. – and this tells me that the company is biased towards underpromising.

On the other hand, parent company Askul owns 62.8% – they have board representation so in that sense they’re aligned, but Askul intends to take a hands-off approach.

As-One (one of its main suppliers and a multi-bagger themselves) also owns 7.46%.

Overall the team is at least primed to be good capital allocators: previous ownership by an American Private Equity was beneficial. Management said that this forced them to think about ROE from early on.

Competitors

As a unique business model, it’s difficult to spot direct competitors and the supplier relationships with other platforms make them more business partners than competitors. With that in mind, I think there are 3 categories of competition.

Direct competition: One company that seems to have a similar model is Biznet. Like APMRO they provide a procurement platform to both Enterprise and mid-sized businesses. They report an SKU of 50 million, less than that of AP. (but then again, how do you define SKUs..) They have >14,000 customers and just like APMRO, they are connected to several suppliers. Though as a private business, their revenues aren’t clear. It’s hard to be 100% sure but my feeling is that they are behind AP here. If you look at their history the CEO of biznet talks about how the original business was a platform to purchase stationary office supplies and only started to focus on MRO in 2020. Somewhat confirming this is that AP has never encountered them in RFPs.

Other B2B MRO distributors: like Trusco, Monotaro, As-one, or even their parent company Askul. What differentiates Alpha Purchase from the pack is that their platform is not just a simple purchase platform to procure items but also provides value-added services. These other players have historically focused on Small and Medium businesses which have simpler needs compared to enterprise (both SKU and Tech-stack). MonotaRO and As-One have enterprise platforms, but the main difference is that AP is a ‘neutral’ middleman between supplier and customer and simply helps you find the cheapest price among suppliers. Whereas platforms like MonotaRO have a bias to sell only from their own supplier network.

By the way, monotaRO also started in 2000 and they also initially went after enterprise clients and failed. This reflects how unlikely it was for a business like AP to get off the ground to begin with.

ERP systems: SAP (Ariba) and Oracle both have procurement modules. These don’t have a direct connection to the >3000 suppliers that Alpha has. I remind you that Alpha Purchase has placed themselves in the value chain as an integration partner. Most of their enterprise customers use SAP as their ERP and would combine APMRO into this core workflow.

FM is also in a similar situation where some of their offerings overlap with potential competitors. However, it is more typical for customers to ask one firm to take care of the whole Facility management. Listed comps here include Aeon Delight and Shin Maint holdings.

Valuation

I think the math is relatively simple. The stock trades at a P/E of 13x today or 10x adjusting for cash.

So an earnings yield of 10%. This is despite the heavy investments leading to depressed margins. Earnings I think, can grow at least 10% annually over the next couple of years. I believe there’s latent scale benefits but the company doesn’t expect margins to improve for a few years as they want to focus on scaling. So revenue growth will be the main driver of earnings for now but in a few years, I think they should be able to expand margins accelerating their earnings growth. Management thinks by the time they reach 100 billion in sales, their operating margins can hit 4 to 5%, almost double from here.

For simplicity let’s assume fully diluted EPS grows modestly at around 10% a year through 2026, apply a P/E of 18 times and we get a share price of 2000. Adding back 250 yen of cash per share* (I’ve assumed 0 cash being accrued during the period) We arrive at 2260 yen. That’s already a 3-year IRR of 26%.

I think the maths here is fair. The TOPIX is valued at 15 times - for a moaty business with double-digit ROCE and growth it justifies some premium. Peers trade well north of 20 times. And remember this 3-year model doesn’t even capture the full opportunity with a possible inflection coming later on. If revenues grow faster and margin actually doubles over the next 5-6 years, earnings CAGR will be >20%, not the 10% i’m proposing. The time to reach those margins will be shorter the faster they can grow. Which is not out of the question.

Let me remind you that revenue from existing customers alone grows by 10%.

Free cash flow in 2023 was weaker from an increase in working capital in Q4 – this fluctuates quite a bit and can understate the actual ability to generate cash. The company explains it’s a temporary increase because one of their customers is rapidly opening new stores leading to a jump in new projects for FM and thus receivables, so its more of a timing issue. Cash conversion should be close to 100%. There might be some ups and downs in working capital but I find it unlikely that this keeps increasing. Unless of course, the store construction part keeps growing at a much faster rate than the rest of the business…

Another point that’s up for debate is if the cash truly belongs to shareholders. Distributors need cash collateral to fulfill payment cycles, so this is not easily extractable. That said, I see no reason why a consistently profitable company cannot finance short-term liquidity needs with debt if necessary.

*Per Share Cash is calculated after deducting 1.5 bil from Q4 Cash. This is a temporary build-up that gets paid out to suppliers at the beginning of the following month.

Comparing with peers

Qualitatively the main difference is that the peers below are actual distributors. They own warehouses, provide logistics et cetera. These services justify higher gross margins for them as they provide physical services to the customers which they should charge for.

Don’t forget though these have comparable ROCE and given that AP focuses on the digital part I don’t think this margin differential is something to be overly negative about. AP is more capital-light as they don’t need to invest in logistics. Not to mention, they’re growing faster than others (on par with MonotaRO).

Another point I like about AP, is that their clients are Japanese Blue Chips so the business is likely to be impacted less by cycles relative to SMBs. With that respect, I think AP has a more stable customer base compared to MonotaRO.

As such, I still think the valuation gap is still too wide.

Inverting the process…

The 2026 P/E multiple based on my assumption implies that there won’t be much growth after that, which I find unlikely given the opportunity set. Thinking more holistically here, if we were to buy out this company, how much would it cost? This is a business that has a wide moat, strong reference clients, predictable revenue streams, and critical solutions with plenty of growth ahead. Hence my initial question – is a valuation of 10x P/E appropriate? I sure as hell would be happy if I could acquire it at that price today.

Why does the opportunity exist today? A few potential reasons.

1. AP is new to the public market and has limited following and liquidity. It’s far too small for any institution to touch this especially as it is listed on the TSE Standard. Why IPO at this scale? It looks like they are preparing to capitalize on the ERP upgrade cycle which should start showing at some point. Overall though this business is underfollowed. Look at this live stream of their recent AGM below. It’s mostly empty seats! I mean it’s a boring business: we live in a country where retail investors are looking for the new AI play or the new Dividend Champion, and this business distributes MRO parts. Likely, the business model isn’t understood well yet. Management acknowledges that and is actively looking for ways to educate investors.

2. Askul IPOd this business and is now essentially a parent-child listing. This is gaining more scrutiny due to the TSE cracking down on governance reforms which may lead to a discount.

3. Alpha is guiding for ‘slower’ revenue growth for the next year of 10% (compared to mid to high teens historically) and concurrently profit growth is expected to be muted for 2024 as the business focuses on investing in resources to prepare for growth. From next year on I think their earnings growth can resume, potentially at an accelerated rate. Nonetheless, I also think their guidance for this year is being sandbagged.

4. Theres been feedback from investors that margins are low. Given the gross revenue accounting if you look at gross profit/EBIT ratio this is closer to 23% which I think is the better metric. It’s important to understand that their ROCE is mid to high teens. Given the margins and focus on growth without an explicit mid-term plan, I was also initially uncertain about its margin trajectory and whether this could deteriorate in the next few years. However, the CFO recently mentioned in a retail investor presentation that they intend to maintain a stable margin, which is an insight I think not many have picked up on. Many don’t know that it’s been profitable for 15 years and are unlikely to go into the red. Enterprise companies don’t want to outsource critical components to a loss-making company as this risks continuity.

Their margin can fluctuate based on % of sales coming via Askul and other EC platforms (lower margin) in addition to personnel and IT costs. The Askul portion is hard to control but the remaining EC portion is not expected to keep growing in share as they’re not usually the cheapest.

Their recent AGM, I count 5 people and lots of empty seats…

What makes it a good stock?

The business is something I like – there are some reservations with the stock I have which is worth keeping in mind.

One of the main challenges in investing in companies of this size is understanding the incremental buyer. In this instance, institutions won’t be able to touch it for a while. Thus the incremental buyer will be other individuals for now, who typically love short term performance. So price discovery for such a stock may not occur unless there are significant catalysts and may entail a return on time risk (the stock may not do anything for an extended period). So the re-rating might occur much later. It’s unclear how much of a catalyst the potential acceleration could be, and the inflection in margins is unlikely for the first 3 years. I’ve assumed the fair P/E should be at least 18 times for a growth biz in Japan but it might not re-rate in this period.

And be mentally prepared the incremental sellers are also individuals – which can lead to volatile price movements in the short term especially as quarterly earnings vary widely.

Management is also clear that they have every intention to re-list on the TSE Prime from its current TSE Standard – when this happens, I believe the re-rating could be substantial as more institutions at that point will be able to invest. To get there they’re committing time to improve recognition from individual investors through PR, better disclosure, and public presentations.

There is still a long road ahead to realize this, but they are serious about getting there. Management calculated the stock price needs to be at around 3000 JPY to be eligible for a Prime listing.

Having said that given the quality and the valuation, I am willing to patiently hold and follow this stock and add when the opportunity arises. I think there will be some more attention to this stock as profits start rising again. Let’s just hope the company’s name doesn’t jinx itself!

Risks:

ROT risk: As per above, it might not trade at a fair-looking multiple for a while.

Cycle risk: The business is steady but it may not grow in a recession. Revenues for decline by much (if any) but still, it won’t grow. In the FM side 30% of revenues are project based reliant on the customers expansion plan, this could lead to some volatility in earnings for this segment.

Execution risk: Management has been running this for 16 years and its in firm hands. Running a public company is a different ball game and this may get them in trouble. (I’m comforted by a CFO that has public market experience at a much larger firm). To scale the company needs to be able to hire successfully to meet the increasing demand. A positive sign so far is that since they went public, their employee attrition more than halved from 12% to 4%.

Customer onboarding: We see this a lot in Japan but companies can screw up onboarding large customers which they expected to be a growth contributor for the year.

Customer concentration: The top 3 customers in the FM division are 80% of turnover, It’ll be painful if one leaves. However, it gets harder to switch away as APs services get more entrenched. On the other hand, if this segment grows too quickly this might eat up cash flow as the working capital structure is slightly different for large reno projects. So something to consider carefully nonetheless.

Supplier Risks: Right now, 40% of sales comes from their top 3 main suppliers: Askul, As-one and Trusco Nakayama. But I think risk of supplier dependence is not high as 2 out of the 3 are significant shareholders of Alpha Purchase, essentially aligning interests. Askul owns 63% of the business and As-One owns 6.7%. Other well-known platforms like Monotaro and Amazon are within the supplier network but constitute only a small portion of revenues for Alpha Purchase. In effect, you can argue AP as a true neutral intermediary so there’s not a business that’s quite like APMRO.

Stock dilution: Over the years, the company has built up unexercised stock options that will dilute the current shares by 7.75%. It doesn’t sound like they’ll be giving out stock-based comp too generously, if they do the dilution might be worse than what I initially assumed.

Appendix:

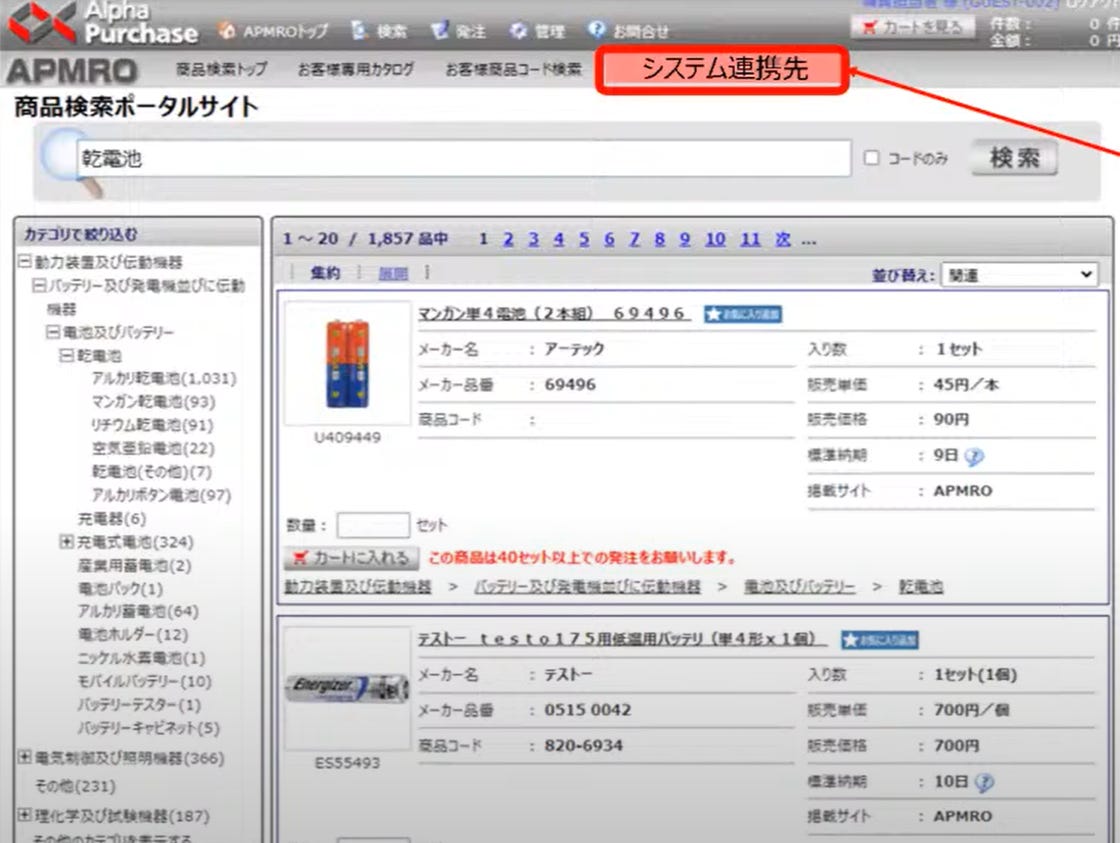

Snapshot of platform

Low churn:

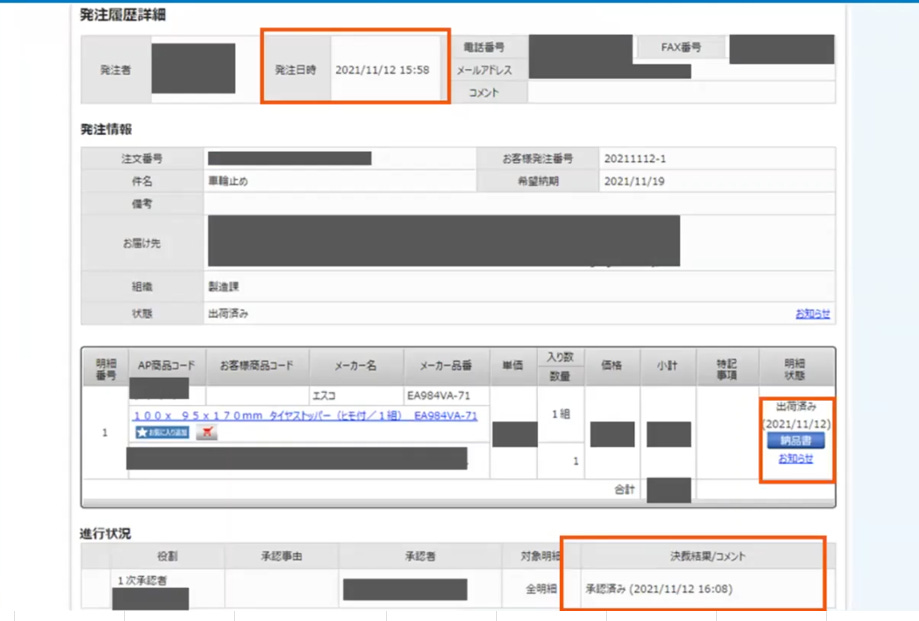

Order tracking on platform:

What happens after they land a customer:

Thanks for the insights! Will take a closer look at it.