Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. It may include some errors, please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclosure: The author currently owns shares in the company as of 21 June 2025. The security could be sold at any point in time without prior notice.

Every now and again, I come across a ‘dumb bet’ I take that is really just a Jocky bet at a cheap valuation. Truly, it’s a very lazy form of investing and certainly not a process a professional money manager may be able to justify so please don’t hate me. That said, as I don’t manage outside capital, I’m happy to serve as your designated lab rat.

This would’ve been perfect as a ‘one-pager thesis’ but alas, the stock price decided to move faster than I could write. It ended up being more of a two-pager (Sorry). However, thought I’d share it anyway. Clearly, the risk/reward isn’t as attractive today but optically still doesn’t look horrible, so if you aren’t too anchored to how it has moved recently, perhaps this one is for you. In each case, I felt this one deserves to be on the watchlist.

This is an interesting idea to me and one that actually serves as a ‘Part 3’ of my Hikari Tsushin series. (See Part 1, Part 2) i.e. I’m profiling an interesting company I found through their ownership. This isn’t just Hikari-owned, though; that would just make them one of 800 holdings. But what if I told you there’s a listed subsidiary focused on a specific vertical? I happened to be bullish on this particular vertical for Japan, and has a business model I like! They’re already a market leader for many of their key businesses. So the point was, what happens if Hikari people run this? I guess you can think of it in a similar way to some of the offshoots of Constellation Software and their many listed child/grandchild companies.

Kusurinomadoguchi (Ticker: 5592)

Market Cap: ¥34 billion ($230 million)

LTM P/E: 16x

LTM EV/EBITDA: 9.9x

ROIC: 22.8%

Now say it fast 5 times! I know, the name is a mouthful and might sound intimidating but it literally just means Medicine Counter in Japanese. Such a creative name, right? (So Japanese…)

The thesis for me is simple:

The main point here is that if Kusurinomadoguchi continues to achieve revenue and profit CAGR of 20%+, at the valuation today of 16x P/E and 9.9x EV/EBITDA this would be an asymmetric opportunity.

Importantly, I believe if they execute with the attribute of Hikari’s capital allocation focus i.e. IRR focused and Shareholder friendly, I believe there will be significant shareholder value creation. Furthermore, I’m betting this makes the odds of them achieving this MT goal higher than the average Japanese company. Not to mention, the biz likes predictable, recurring revenues.

In short, this to me is an expression of the Hikari opportunity but one that’s more focused on an industry with significant tailwinds in Japan. Consequently, the industry focus also makes the competitive dynamics/advantage a little more intuitive to understand, unlike its parent. This may sound like an exaggeration, but if they do it right, I think they can become an incredibly valuable infrastructure for Japanese healthcare.

Business Description

This is an interesting business that can be seen as a grandchild of Hikari Tsushin. It was spun off from one of Hikari’s EPARK, which has been a subsidiary since 2014 under their Solution Segment. EPARK has been their division that focuses on IT business solutions (yes, this is another software idea..) in typical Hikari fashion, a business that focuses on recurring revenue. One of their primary service at EPARK has been a booking service for food retail concepts.

Kusurinomadoguchi was established soon after in 2015 (from here on i’ll abbreviate to KMG to save myself 5 hours of typing this long a** name) as an offshoot of EPARK and further specialised in the healthcare vertical, as the name might suggest. In effect, they started as a booking service for pharmacies and drug stores, where customers can ‘book’ their prescription in advance. Again, the main attraction here is that it has a strong focus on recurring revenue. I also like that the focus for KMG has been to provide digital solutions for the healthcare industry, which has been prone to acute labour shortages and analog processes (read: unbelievable inefficiency). DX remains a huge opportunity across all aspects of healthcare. The government recognizes this too and I believe such demand will only continue to rise.

Like Hikari, it has a confluence of businesses within its segments, hence making it harder to model. KMG consists of 3 operating segments. I’ll describe each below:

Media

This segment’s main concept has been to “Connect healthcare to patients” and can be seen as the genesis of KMG as it houses the main EPARK Kusurinomadoguchi biz. In a nutshell, this business aids pharmacies with customer acquisition and retention. The main Kusurinomadoguchi is a portal site for consumers to help search for nearby pharmacies, and with it the capability for patients to upload prescriptions digitally and book a pick-up ahead of time, either via website or mobile app. Streamlining this whole process. This adds value for pharmacies because the platform provides visibility for them. They know in advance what medication to prepare (i.e. better inventory control) and operational efficiency, where such entities are already quite stretched due to a shortage of personnel. Patients win too, as this minimizes wait times at a pharmacy where you may be prone to other diseases while you wait. Inevitably, others with different sicknesses are walking into this closed space.

In tandem, KMG provides consumers a medical prescription record app solution ‘Medicine notebook’ for patients who can scan and keep track of all prescriptions and comes with other handy functions like a reminder alarm to take your medication, manage your personal health record etc. Of course, users can also use the app to find pharmacies that are most convenient to them. Patients can also choose to select their ‘primary’ Pharmacy, which further streamlines the prescription booking process. This in turn, heightens the repeat rate for pharmacies.

KMG also provides ancillary ‘Pharmacy Support’ Service to help Pharmacies improve their operations, such as inventory management.

There is a recurring revenue component in each service. The main portal service will initially charge a one-off fee when a pharmacy gets a new customer. Following that, pharmacies will pay a monthly recurring fee for every registered customer. Note that this does not tie to the number of prescriptions but rather the # of patient data they decide to keep on hand on the pharmacy’s database. In addition, there are other monthly subscription services like the ‘Rich’ plan, which improves the visibility for paying pharmacies in the portal (like a typical classified biz) in addition to other features. The other is the ‘pharmacy support’ service, which is also a subscription business.

There is close to an estimated 60k pharmacies in Japan and KMG is the market leader here with 37.3% of them on the platform (and growing). On the other hand, its only penetrated 1.7% of 420 million estimated annual prescriptions they target - a figure which they define as their SAM (Servicable Addressable market). Digital prescriptions are still not familiar to many consumers and pharmacies today, but a behaviour that could increase over time. Given the penetration is still so small today, there is room for growth. Note that this only considers long-term and pediatric prescriptions. In reality total estimated number of annual prescriptions is higher.

Of note is that KMG is the market leader for their portal and prescription record apps both garnering high ratings and very positive customer reviews. For their ‘Prescription record’ Medicine Notebook app, theres been more than 6.5 million downloads which is a 4x in total downloads over the last 5 years.

While there are other players for Medicine Notebook, KMG seems to be in a dominant leadership position due to the inherent network effects. As there are now 37% of pharmacies on the platform and more than 6.5m users. Competitors of this include Pharms, which is from another very interesting company Medley (4480.JP). This is also an interesting stock that may be worth looking at. My friend Jake did a great write up here. Although looking at the Pharms website, they tout 1 million total downloads, which is smaller than KMG - and has fewer pharmacies as customers.

The key here is that I think KMG has reached critical mass, that it doesn’t make sense for pharmacies not to list on their platform, as it’s a valuable customer acquisition tool. While it is not disclosed, churn is reportedly low. 61% of major pharmacy chains and 81% of major drug stores are now on the platform. Interestingly, some of these chains also have a similar app, but the available pharmacies on such apps are selective, so the value proposition is nowhere near as attractive. So I believe the flywheel is now at a point where it’ll drive growth and the moat will get stronger.

Additionally, patients who use the platform can be captive users, as no one wants to keep uploading sensitive medical information to multiple platforms. It’s also easier to track your own prescriptions by saving them all in one place.

Minnano Okusuribako (MOB)

I know, even the names of the segments can be a mouthful. Minna no Okusuribako means “everyone’s medicine box”. This is a business that focuses on 'connecting pharmacies to pharmaceutical wholesalers’. Again, it has 3 main businesses under this segment, and they're all quite interesting.

a. Shiire Support (Procurement support): provides collective procurement of medical products on behalf of pharmacies. The pharmacy market is highly fragmented so the idea here is that with more pharmacies procuring through KMG, they can buy items from wholesalers for better rates. Naturally, the key here is the increasing economies of scale - the larger the number of pharmacies that participate, the better it becomes for everyone. KMG in return, earns a fee which isn't 'recurring' in the strictest terms, but by nature, there’s limited cyclicality in demand for prescriptions.

b. As an extension of this, KMG also provides an eOrder system, which is a solution for inventory management and automated ordering for pharmacies. By connecting this directly to a pharmacy’s ERP system and by reading the prescription data of patients, it predicts the necessary quantity of medication that needs to be restocked, and if the pharmacy is part of the procurement program, it will send orders directly. Such a solution can reduce over-ordering of products, limit the risk of supply shortage and reduce the administrative burden. This helps improve cash flow for pharmacies and reduces waste/logistics costs for distributors. So the value add can be huge. This follows a more traditional subscription model.

c. Finally, in Japan, it is estimated conservatively that more than 100 billion ¥ worth in medical products go to waste annually. In order to solve this KMG created a marketplace for Pharmacies to sell their unsold inventory ('Deadtstock') to pharmacies that need it at a discount, thereby reducing waste. It’s a win/win for all parties involved!

The main fee component here is a percentage of the transaction for 1) and 3), which is recurring in the sense that such purchases tend to be more defensive. 2) As described earlier is more of a subscription model.

Of note here is that Medical System Networks (Ticker: 4350) has been the incumbent in this space for collective procurement. But KMG has surpassed the number of pharmacy customers with 17,901 pharmacies versus Medical System Network’s 11,003. Which is impressive. This demonstrates their ability to cross-sell this service to customers in their Media business. The common thread with the Media business is that they’re very good at selling and acquiring new customers. It seems likely that with such a customer base, theres likely to be more opportunities to upsell new services and features in the future.

Core Systems Business

Last but not least, the core systems segment provides a more traditional IT services business for healthcare providers, offering a portfolio of solutions to Pharmacies, Nursing care facilities, and Hospitals. The business consists of an 'initial' installation fee and a recurring subscription/maintenance fee. There are too many units, so I’ll just put an overview from the company.

It’s a lot of small software companies here. Typically, they’ve seen growth mainly coming from M&A with a strong focus on valuation. The chairman also comments that they acquire businesses that have been generally ‘legacy’ software, which they then develop new features for, including a cloud module. This also leads to organic growth. In a way, this almost sounds like a VMS consolidation arm for KMG akin to Constellation.

One thing to note here is that this segment saw some one-off tailwinds last year from the government subsidising the adoption of digital systems for pharmacies. This was a one-off, so it will disipate. (Approx contribution of 200mn in Q2 and Q3 last fiscal year). Whilst this was very much temporary, it also goes to show how important it is for the government that the healthcare industry needs to adopt more digital solutions. Thus, there is a clear upside potential that there will be similar initiatives from the government in the future. Credit to the company for also breaking this out in their guidance!

Growth

So… as you can see, like it’s Grandparent Hikari, it has several segments which in turn have multiple business units with various drivers, making it harder to model… this especially because each segment is also similar in revenue scale. They also don’t split out margins.

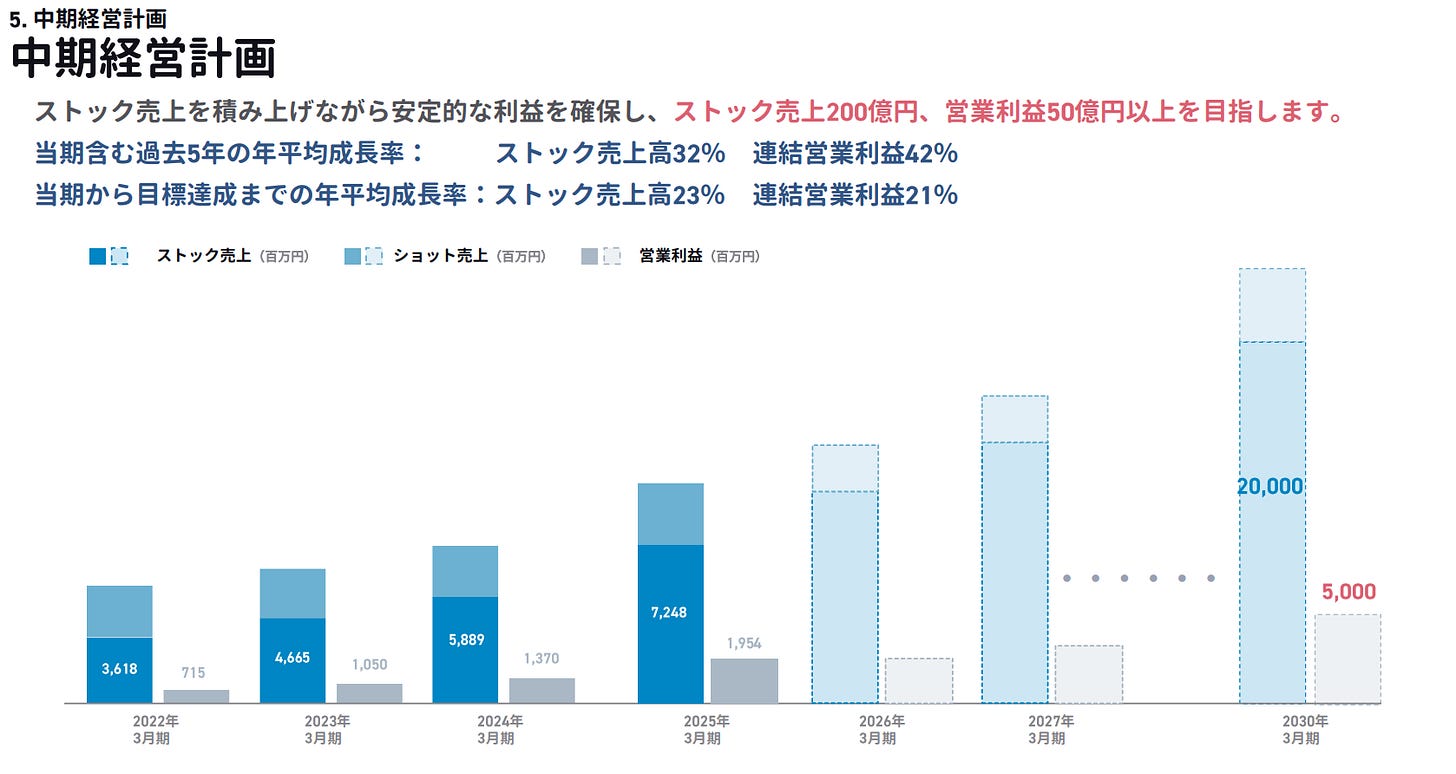

However, they recently came out with a solid Mid-term plan for the group level.

Recurring revenue growth 5-year CAGR: >23%

Operating profit growth 5-year CAGR: >21%

According to the company, most of this is expected to come from organic growth and some M&A via the core systems segment. Although they don’t split this out. Having said that, it also seems to be a rather ‘conservative’ target on their part, even though it may not look like it. The nuance being that they mention they want to achieve more than the mentioned targets. Mindful that it’s dangerous to extrapolate, in the context of what it’s done in the last 5 years, it doesn’t look too bad either. Recurring revenue and Operating Profit CAGRed at 32% and 42% for the last 5 years, respectively.

Besides, I think they understand capital markets, and this seems like what Hikari would do too, which is to keep expectations low. The Chairman has also been explicit about not wanting to ‘downgrade’ forecasts.

The tricky part is that it’s hard to figure out which of the 3 segments will really drive earnings for the company. It seems the management expects a degree of solid growth across all its reporting segments. Hence why I had to dumb down the thesis, which comes down to “Can management really help create enough value to sustain this 20%+ revenue/earnings growth?”

Understandably, this is harder to assess, but one thing worth thinking about is that healthcare, in an aging population like Japan, has significant tailwinds - and I believe Digital Transformation (DX) will be one of the most attractive ways to play it, given the latent value creation this provides. So whilst the growth in the MT plan looks high, I believe there are sufficient tailwinds to support this. The addressable market is also huge for these businesses. Theres an estimated 60k+ pharmacies in Japan. Ladies and gentlemen, that’s more than the number of convenience stores in the entire country! (somewhere around 57k, if you were wondering). Medical wholesale, they estimate to be a ¥10.9trn market, implying their MOB biz is only 2.1% of that. I believe they can keep winning market share in their main services.

Whilst the solutions in each segment can differ, there are similar growth levers to each: continued customer acquisition and upsell of additional features to said customer base. The upsell component is interesting as this helps further entrench KMG into the customer’s wallets. There’s added long-term optionality for KMG to develop new solutions for their existing customers to upsell. They seem to listen closely to their customers to develop solutions, which means generally, there’s a product-market fit. It’s been pretty impressive to see how they’ve scaled new services in just a few years. In addition to that, I wonder what kind of new services they can develop as a result of all the data they amass through the various businesses.

Second part, and this is the main ‘dumb bet’ part, is that I’m expecting the management to employ the Hikari Tsushin playbook for this specific vertical.

Management

So what does this actually mean?

Firstly, the genesis of KMG is closely intertwined with Hikari. Tanaka-san the Chairman was previously the Co-founder and CEO of Freebit (Ticker: 3943.JP), he also started several businesses before that. KMG was then established in partnership with Hikari in 2015 where he also became the CEO. Eventually, Tanaka-san stepped down from his position at Freebit in 2020 and took over KMG through his holding company to focus solely on this. Concurrently, he became chairman and Tsutsumi-san became the CEO. He saw this as the ‘second founding’ of KMG.

The key link to Hikari here is this CEO who has been at Hikari Tsushin since 1999 and through the last 25 years he’s held multiple management roles there. Now remember, the environment in which he operated was highly competitive, and he survived through all that. You could say he’s been battle-hardened and taught the value of recurring revenue and IRR, which is pretty much a mantra for Hikari at this point. He eventually became the Vice President of EPARK in 2014, then Vice President of KMG in 2016, and eventually CEO in 2020.

One thing I really like about Hikari is that they have been able to figure out how to sell recurring services/products well, and in doing so, generate an IRR of close to 30% as we discussed here. Assuming that this discipline also translates into how KMG operates, I believe the current valuation could prove to be too cheap (yes.. even after a strong move up in the last 12 months). IF done right, theoretically at least the IRR potential should be larger for KMG than Hikari because 1) the inherently smaller size should mean the company should be able to scale at a faster rate and 2) with KMG providing an asset light service portfolio in a pretty critical industry should translate to business economics more attractive than the average Hikari business, given that they’re so diversified. One positive signal is that KMG management explicitly focuses on recurring revenues and even splits this out for each segment. This has Hikari’s fingerprints all over it. They have also mentioned IRR is a key focus, and something they track constantly.

Furthermore, I would think they will likely have a few tricks up their sleeves when it comes to selling. Hikari’s main strength has been its incredible ability to sell. Whilst this will be more of a targeted audience, it’s highly likely to me that there will be some strategies that they can adopt from Hikari to employ in this vertical. The chairman has even mentioned sales has been one of their main strengths! As a listed subsidiary, KMG likely has direct access to Hikari’s resources too. FYI, selling IT solutions to medical professionals, especially doctors, has been notoriously difficult in Japan. I’ve heard a few companies mention that one of the main reasons for this is that doctors don’t have time to meet salespeople. There are other reasons, too like the fact that this particular demographic is resistant to new tech adoption. So companies can’t even get a foot in the door to begin with.

Finally, and perhaps the most important to understand, is that being a Hikari company should mean that they are shareholder-focused. In other words, they’re likely to be good capital allocators, which includes their ability to conduct disciplined M&A and otherwise return capital to shareholders. Hikari owns close to 30% today, and such alignment of interest should provide some guardrails.

Valuation

I think there are several reasons it’s cheap:

One is that some might find it too complex. As I alluded to at the beginning, even though it’s just 3 segments, they have various businesses under them! So it’s a little more complex to understand the growth mechanics of each. The lack of English disclosure likely doesn’t help either (and hence why I’m writing this!). It also makes the key risk identification more difficult i.e. what part of the business get screwed. If it’s any consolation, because it’s diversified, the risk that KMG gets completely disrupted is low. Although there are some specific risks (discussed below)

Their collective procurement business saw a sudden deceleration, which may look a little worrisome. The main reason this happened was that their partner Global-H which was responsible for procurement and negotiation with primary wholesalers, was not doing well and got acquired by Sugi Pharmacy. This required KMG to find additional partners and update the terms, which meant that KMG also had to halt sales activities. GMV fell as a consequence. This was temporary, and with their new partnership with E-BOND, they expect this business to pick up again.

Related is that free cash flow was negative in FY03/25, which does not look good for what’s theoretically a very cash-generative business. However, this was ultimately due to the change in terms requiring an adjustment in payables for their distribution biz, which was way inflated. With the changes in scheme, it required some adjustments and this meant terms for payables were shortened. This increased net working capital significantly YoY eating away at FCF. However, we can expect this to normalise. Like most distribution businesses, I expect this to have negative working capital going forward. According to the Chairman in a recent interview, adjusting for one-offs, operating cashflow was north of ¥2bn. (I’m guessing closer to ¥3bn)

You’ll notice that ‘intangibles’ Capex is very high, representing close to 16% of sales. This can be seen as a negative since accounting earnings will look better. This is mainly due to capitalising investment in intangibles… (i.e. Software development) Whilst it’s unclear how this would trend exactly for KMG in the next 5 years, I’d expect as a % of sales to gradually decline (which it has so far…). The company has been investing heavily in growth for both existing products but also for new ones, which they absolutely should. Again, this is a moment where you’ll have to trust that they are really IRR focused like Hikari and the efforts should ultimately lead to FCF inflection. Theoretically, this business should be highly free cash flow generative and the normalised FCF should be higher. Recall that the business was only founded late 2015 and has scaled at a breakneck pace. With them still early in the S-curve, I believe it makes sense to continue investing (sensibly). As the working capital normalises for the distribution biz, it should also be accretive to FCF.

The company’s low float (still majority owned by Founder + EPARK/Hikari) leads to low liquidity. This also consequently meant no coverage, which is a good thing for us in this case..

Also be mindful that the EPS can look higher due to tax loss carryforwards/NOLs, which they are able to use for the next 5 years. This mainly came from acquiring an initially loss-making business.

Now, having said that, my assumption here is really lazy and simple. IF they achieve their 5bn EBIT target by FY30, that's like a EV/EBIT multiple of 6x... (When I first looked at it it was more like 4x) and this is before accounting for any cash accretion on their B/S, which should further compress the multiple. And remember, the language in the MT plan was to generate more than ¥5bn in EBIT by FY30. Management seemed to imply they’re being conservative. Guidance for the last 2 years were also quite conservative and they consequently upgraded them so there may be a pattern here.

On the margin side, LTM operating margin is currently 17% and they target 25% in 5 years but the true underlying profitability could be higher as much of these businesses are highly scalable. Especially for the media business. Similar search platforms for different verticals can fetch operating margins >40%. While they’re unlikely to increase margin too much since they’ll likely focus on growth, there is an inherent operating leverage potential.

Risks

The most important one is that I’m wrong about management. This is effectively the main thesis i.e. that they’ll be good at allocating resources to scale this business profitably. If my hopes that this is the ‘second coming of Hikari’ is wrong, then… I’m screwed. So far, they’ve seemed to have done well. Ultimately, the chairman also has a significant skin in the game, owning 28.6% through his entity NBSE. As does Hikari with ~30%.

Its direct parent EPARK also seems to have had to go through some restructurings in recent years. Though matters there seem to be isolated, it could potentially trickle down to KMG. Now, having said that, Hikari remains a ~30% owner in KMG and I like to believe that the company will continue to support the growth of this company.

As mentioned before, there is ALOT of pharmacies in Japan, it’s kinda crazy. Though it’s always been something talked about widely, we may eventually see a decline in the number, whether due to industry consolidation or closures. This in turn, could be a headwind to growth for KMG.

Resistance in consumer behaviour: Whilst there are already 6.5 million app users for their Prescription app, there may be a ceiling. However, I believe there is a very real value proposition that is offered here and I think KMG can scale this further. The company sees 20 million as a milestone, where the Chairman believes that could be the point at which they could really become an important ‘infrastructure’ in Japanese society.

Regulation: The drug market in Japan works in a way such that reimbursement rates are reviewed every 2 years. This generally pushes price down. This could squeeze margins for KMG’s procurement business. Having said that, regulation is seen as a net positive by them given that this would push more pharmacies to operate more efficiently, driving demand for solutions provided by KMG.

Now mind you, I’m basing the valuation on a 5-year horizon. It fits in just a few cells on an Excel model but that’s a looong time! As I like to say: “The tragedy of human temperament is that it takes a few seconds to pull up a long-term growth chart, but much longer to experience it.” There’s likely going to be some ups and downs in the business and the stock. This was no different for Hikari, which has also gone through its own trials and tribulations.

SBI Capital could exit completely at some point, so there’s some overhang risk here. It’s not impossible that Hikari throws in the towel if one day they underperform too much at which point they may dump shares too!

Conclusion

It's a bit of a messy business, which makes it hard to invest with a very high conviction but I thought KMG was worth taking a small bet on, given that this was a business that operates in an industry where I expect significant tailwinds i.e. healthcare. I like that KMG plays a part in solving a very real societal problem we have in Japan - and it is able to do that with a more or less a portfolio of predictable business models, some of which have strong market leadership.

To repeat, the biggest attraction here was its affiliation to Hikari Tsushin, which I believe should enable sensible capital allocation practices, high IRR on capital, consequently leading to meaningful value creation and ultimately, shareholder friendliness. Hikari has so far proven to be good at what they do, but also remember that given the nature of their ultra-diversified operations, this also invites some 'diworsification'. KMG I think, could provide an indirect exposure to Hikari while riding a focused trend in an attractive industry.

Still early days for this company, and has lots to prove as a recently listed company. So there’s risk in that. However, they also get to leverage the know-how and experience of a company that has years of it. We've seen how they've been able to help Premium Water Group (Ticker: 2588) achieve a market leadership position. It's regrettable that I couldn't get this one out sooner, as the re-rating seems to have played out. But the valuation is certainly still not one to completely balk at…and things like this can lose momentum at some point, so one that may deserve to be on your watchlist!

As always, thanks for your time

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. It may include some errors, please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclosure: The author currently owns shares in the company as of 21 June 2025. The security could be sold at any point in time without prior notice.