On a true Made in Japan company Part 1

Profiling a unique business on the Japanese stock market

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

I’ve wanted to write this one for a while but the stock just keeps going up…

One of the main themes I think about with Japan is what becomes valuable as the declining population leads to scarcity? This to me is really what “Made in Japan” products are going to be, high quality, sought after, but scarce. In other words a luxury product of sorts.

In my mind, the most interesting are those that can exhibit pricing power sustainably. This makes sense if you think that demand increases and supply shrinks. Seems obvious but has not been easy to do especially because we’ve been in a deflationary economy. Who the hell raises prices when everyone’s lowering them?

This is starting to change of course with inflation numbers sustainably positive for the first time in decades. But there’s one that’s been doing this for years now…

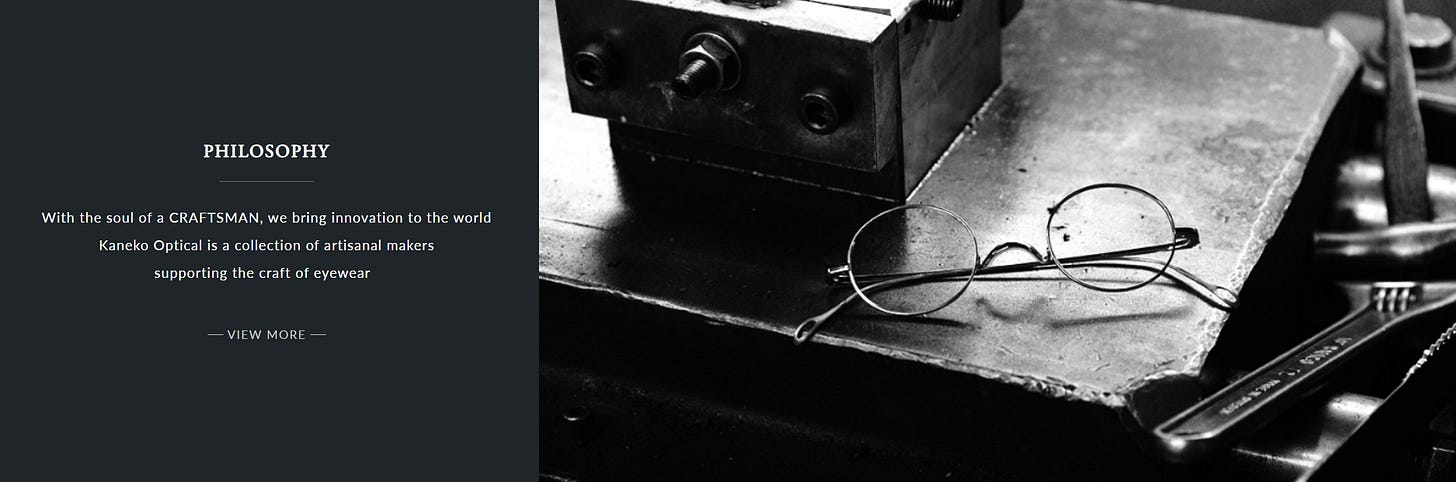

Loved the idea since it IPOed last year as it perfectly exemplifies the namesake of this publication. Reflective of the philosophy of high-quality manufacturing and craftsmanship that can garner pricing power with the powerful designation “Made in Japan”. (Warning: This post will contain an obscene amount of the term “Made in Japan”). Not just that, they’re building their own brand moat. I’m disappointed I didn’t write this sooner.

The company I’m discussing today is Japan Eyewear Holdings (JEH). Let‘s dive in.

Overview:

Ticker: 5889

Market Cap: 71 billion Yen ( $450 million USD)

NTM EV/EBITDA: 14.2x

NTM P/E: 26.5x

Gross Margin: 77.5%

Operating Margin: 28.7%

ROIC: 12.2%

Summary:

Japan Eyewear Holdings (JEH) is one of the few available publicly listed luxury plays from Japan.

The company will see strong tailwinds from inbound tourism and global expansion leveraging its position as a ‘Made in Japan’ product. With higher ASPs in China, this could help sustain high growth for many years.

With its ability to raise prices, investors will appreciate this as an attractive ‘inflation-proof’ model.

It’s still early days for international expansion and their Brand awareness is still limited but moving in the right direction, this is an expanding moat.

Potential opportunities to expand margin beyond current levels as they employ their playbook on their Four Nines acquisition.

As the preferred acquirer in the luxury eyewear space, JEH is set to provide some upside surprises through M&A, potentially becoming a quasi-consolidator in the industry.

The business

Is simple, they produce and sell high-end luxury eyewear.

Japan Eyewear Holdings is a recent merger between the brand Kaneko Optical and 999.9 (read as Four Nines) in 2021.

Kaneko Optical can be traced back to 1958 when it was originally founded as a mass market wholesale company for eyewear. In the 80s and 90s, they moved into original brand eyewear with brands like Blaze and SPIVVY.

In its early days, Kaneko Optical was more focused on mid-end products. Their focus on luxury relative to its length of existence is recent, which started around 2010.

It was the current CEO, who pivoted Kaneko to create a luxury brand going back to its roots with the name “Kaneko Optical”. Today their glasses are priced at more than $450 USD. (Mind you, at the current weak JPY rates)

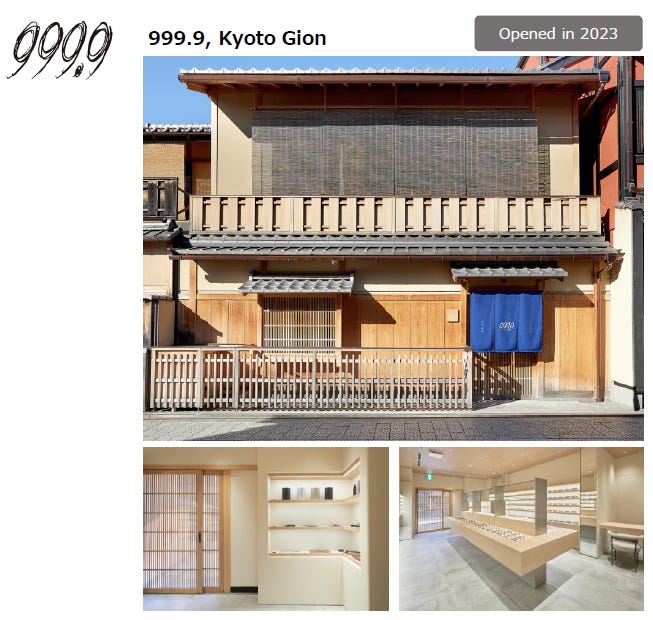

Four Nines on the other hand is a ‘younger’ business which was founded in 1995. This business also focused on quality eyewear but has changed hands several times through the years. JAFCO took a stake in the brand in 2007 which then got transferred to PE company CITIC in 2012, finally being acquired (technically merged) with Kaneko to form JEH in 2021. Nonetheless, Four Nines has also been able to establish itself as a luxury eyewear favorite over the years.

Today JEH operates close to 100 retail outlets and is mainly focused on its direct sales channel, selling elegant, sleek-looking eyewear that stands for quality.

70% of their store sales come from a set of frame and lens, 10% from sunglasses and the remaining from accessories, like just the lens or a protective case.

In theory at least, being a Luxury product and an eyewear product should make them pretty insensitive to cycles.

JEH owns 3 factories in Sabai city and has been building its fourth factory through capital raised in the IPO.

Let’s dig a little deeper into the brand profile of Kaneko Optical and Four Nines.

Kaneko Optical started its luxury Journey in 2010 and has done so quite successfully.

90% of sales come from their own stores, which has been their main focus. This is deliberate to ensure a high standard of service in the store – which in effect is an investment into its brand perception. As you can see from the images the aesthetic is focused on an ‘old school’ but luxurious feel balancing the image of heritage with the quality of the eyewear.

Currently, they have 82 stores in Japan, 2 in France and 2 in China.

Most of their store staff are full-time employees of JEH and are given the appropriate training to meet the standards. It’s not just about the product quality itself but also the purchase journey. They want to make sure the clients are happy.

Their design, quality and luxury feel have not gone unnoticed. Kaneko has its own line with one of the few bonafide global luxury fashion houses from Japan, Issey Miyake, called the Issey Miyake Eyes.

The audience for Kaneko products is quite wide. Typically anyone between the age 20-50 and generally unisex, with a slight skew towards a female audience with the ratio being 4:6 male to female.

Four Nines was founded 1995.

The price point is a little higher than Kaneko. Compared to Kaneko’s stores, its focus is more on minimalist, sleek, elegance with more of a modern touch.

The company mentions that Four Nines has catered to a slightly older demographic, typically men who are in their 40s and 50s, who prefer to wear them in a more formal setting where you might want to combine it with a suit. The overlap of target customers vs Kaneko is limited so you can see the business combination of the two brands was highly complementary.

The main difference here is that as a recent acquisition - the production of the eyewear is still outsourced to other craftsmen in their home Sabae area.

For this brand, they have 15 stores in Japan and 1 in Singapore. Currently, only 49% of sales come from its direct store channel which is quite a difference to Kaneko. Going forward however, management is looking to employ the strategy used for its Kaneko brand and increase its share via its direct channel.

As the brand targets a slightly older demographic, the ASP of Four Nines is also a little higher. (more on that later)

The purchase cycle for either brand is typically around 2-3 years and has a loyal customer base. The two brands have slightly different brand loyalty. 30% of Kaneko Optical customers become repeat purchasers versus Four Nines where the repeat customer rate is 70%. This is simply because Kaneko has been opening new stores more actively leading to new customer acquisition. The underlying repeat rate for Kaneko customers for mature stores is closer to 60%.

Considering that people buy new eyewear every 2 to 3 years on average, this provides a non-cyclical element to the business.

What makes them unique as a Japanese Eyewear company is that they have full control from production to distribution.

This is their fully vertically integrated model which was implemented by the current CEO. Covering the production all the way to retail i.e. from factory to store they control the entire process.

Well… almost all of it. Kaneko is highly differentiated from its main competitors not only because of its luxury positioning but also because of its fully vertically integrated operations. As far as they know, they are the only Luxury eyewear brand from Sabae that does this - and they have seldom seen any meaningful competitors. For their recently acquired Four Nines brands production is still outsourced in the same region and is still in the process of bringing it in-house.

Why this is important is that it helps JEH optimize and gain full control over their 2 key value propositions which are Quality and Branding.

By owning the factories located in their locale of Sabae, they’re able to ensure each crafted piece is delivered at the quality customers expect and to give substance to its luxury branding.

There’s also a common overlay over the 2 factors more generally which is the notion of “Made in Japan” (Woo hoo!). I believe this very designation is important as it is a point of differentiation against major global brands that they structurally will not be able to replicate. (in the end, there are a lot of luxury eyewear brands). This term is synonymous with high quality and perhaps in the future scarcity. Which aligns perfectly with JEH’s luxury strategy.

A little-known fact about Japanese Eyewear manufacturing:

All of JEHs manufacturing operations are situated in Sabae City in Fukui Prefecture. What many of you may not know (unless you are in the industry) is that Sabae is the eyewear manufacturing hub of Japan. Something like 95% of glasses manufactured in Japan come from there.

The rural area of Sabae started manufacturing eyewear more than 100 years ago and today hails as one of the 3 main production areas in the world (alongside Belluno, Italy and Dongguan, China), representing roughly 20% global market share.

In particular whilst Belluno is known for brand and design, Dongguan for low-cost production, Sabae is known for its quality and excellence– falling right into the strength of what “Made in Japan” is so well known for.

Here’s what eyewear retailer Jins has to say about Sabae. Notice that even as Jins pursues a more affordable price range - those made in Sabae are pricier.

Growth Opportunities

The main growth strategy for JEH has been three-pronged. Namely 1) Same store sales growth 2) Open new stores and 3) Raise prices.

1) Same store sales growth

For existing stores there are several drivers:

i) volume growth coming from an aging population and increased brand awareness

ii) growth from tourism

Given the aging demographic in Japan (ie deterioration in eyesight), this should naturally drive demand for eyewear. Especially for Four Nines which aims for an older demographic this bodes well. Furthermore, JEH expects tailwinds from rising tourism with visitors seeking high-quality Made in Japan products. Currently, about 24% of its in-store sales come from inbound tourists and tourism as a driver should be taken seriously. Same-store sales growth was 17% in Q1/FY2025 and 2/3 of that came from inbound tourism.

A large portion of inbound customers are Chinese tourists representing 40% of their sales to tourists. Hence why China has become the market to focus on for their global expansion – in addition to Taiwan and Hong Kong as potential opportunities as well. Interestingly the portion coming from Chinese customers was higher in 2020 representing more than 50% of sales. Indicating a weakness in spending from Chinese tourists currently and seems to agree with what the other luxury brands have seen. Equally, it may mean that there are some opportunities left once Chinese customers return.

If you add Hong Kong, Taiwan and South Korea, this makes up about 80% of their inbound tourist sales.

Currently, many customers walk into the stores not specifically seeking Kaneko eyewear, but more so because they happen to come by one of their neat-looking stores. What this tells me though is that JEH is selling well despite the lack of brand awareness among foreign visitors. This in turn indicates that there is still an opportunity for JEH to grow through expanding its Brand moat.

2)New stores

Over the mid-term the focus will be to expand stores in Japan. However, over the long term, they are eyeing global expansion. Currently, JEH has about 100 stores in Japan and has been expanding at a rate of 5-10 stores a year, however, this includes moving some stores so the real net add is more like 3-5 stores a year.

They see the potential store count to increase anywhere between 120-150 in Japan. Beyond this, they are looking to expand globally.

Store openings cost around 40-50 million Yen per location, which is mainly reflected in their capex. Their main focus for store openings will be its Kaneko Optical brands whilst they work to gradually open more stores for its Four Nines brand. You can consider this cost as their marketing spend as they barely spend on any advertising at all. The company believes the best marketing is to open new stores, at prime locations with a luxury feel.

With already many Chinese visitors purchasing Kaneko products in Japan they see a big opportunity to expand store count in major Chinese cities where the wealthy reside. They currently only have 2 stores in China and are looking to open more. If you follow LVMH etc you have probably seen expanding into China has been a logical playbook.

However, there’s actually another reason why it makes sense more so than Europe at its current scale. As these glasses were originally made for Japanese consumers, the product has been built to fit more Asian facial structures (quite literally Product Market Fit) So it simply sells better right now in Asia than in Europe or the US. This in turn is the current hurdle for JEH to expand into Europe or the West in general, successfully. Currently, JEH has 2 stores in Paris and closed one down in New York. Paris is still loss-making as they simply sell the same spectacles that were originally made for Japanese consumers. In contrast, their Chinese outlets have turned a profit quickly despite being newer outlets compared to Paris.

I think the opportunity for China can be huge, based on the success of their first store, where customers there are willing to pay double the price it retails in Japan and also considering how Chinese tourists represent almost half of the inbound tourist sales within Japan. Think of it this way, I don’t think Kaneko opening 50 stores in China is overly ambitious. At double the ASP of Japan, revenues from China then should theoretically eclipse that of the current domestic sales.

Once they have the production capacity to cater to more ‘Western’ faces, this should be a turning point for their European venture – though no timeline is really given here. It probably makes the most sense for them to focus on expanding in Asia for now given the product fit, market size, proximity and demographics.

According to management, France will be a key market in Europe given the large eyewear market combined with the fact that it has been the ‘home’ of Luxury. If you consider that Kaneko already works with Issey Miyake, perhaps we may even see a ‘collab’ between Kaneko and a major European luxury brand.

To summarise if the global strategy works out, which is already seeing traction and has a decent chance, it’s still eaaaarly days for JEH.

That’s it for today folks! I’m glad to be finally sharing a tangible consumer product that represents the soul of Japan - and a type of business that is truly unique thematically in this country. Next time you’re in Japan be sure to check out their stores!

In part 2, I’ll be digging into JEH’s pricing strategy, margins, management, thoughts on valuation, and other potential growth opportunities.

disclosure: I own

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

Why did gross margins stay relatively stable over the past few years despite the price hikes?