Notes from the Nikkei IR Fair

On the reality of retail investors, shareholder gifting and a few companies that caught my eye...

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. It may include some errors, please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

I recently had the opportunity to attend the Nikkei IR fair on the 23/24th of August and hosted at Tokyo Big Sight.

It was a free event hosted by Nikkei and anyone could participate, chiefly aimed at retail investors in Japan. It was the 19th time Nikkei hosted this with 84 companies exhibiting. It’s wonderful that individual investors were given the opportunity to meet and hear from the companies directly which otherwise might have been more difficult. Some even had their CEO attending

For most of my readers, it’s probably pretty unpractical to attend this so thought I’d give some ‘on the ground’ insights 😊 To me, it was fascinating to see just what kind of interest the general mass has when it comes to stocks.

If you speak Japanese you can also access the archive of some of the presentations here.

Today I’ll be highlighting:

About the event, what I saw, and the reality of who ‘retail investors’ are

Shareholder Gifting

3 Companies that I found interesting (and hidden + not-so-hidden trends)

Thoughts on the event:

I’m rambling on things about what I noticed as a first-timer attendee: the type of crowd and what time of presentations they held. Feel free to skip this and go down to some of the companies I found interesting. (I won’t feel hurt, I promise………)

I joined the on Friday and the event itself was well attended. The event had 84 companies exhibiting and multiple concurrent large-group presentations by some of them as well as fireside chats with experts and journalists. Attending companies ranged from small to large-cap companies but were skewed to the smaller side.

This was the first time I attended an event aimed at retail investors but it was insightful to really see who ‘retail investors’ actually were. It also helped me find serendipity, learning about companies I had not heard of before. Each company had a booth where you could see what the business does (even their actual products) and held mini-presentations where they could seat roughly 10 to 15 people at a time. They would hold the same presentation usually every 60 minutes. For that day I skipped the large group ones and focused on visiting individual booths to listen to their mini-presentations. Afterward, I also pulled the employees aside to interrogate ask more in-depth questions. The general reaction I got from this was a bit of surprise, it didn’t seem that they were expecting to get into the nitty-gritty.

The first thing I noticed was the demographic of the attendees. The people were definitely on the more senior side, my guess would be the average age range was mid-50s but there were many people way older than that. There were a handful of ‘young guns’ (Think mid-thirties and below) but those were certainly in the minority. I also saw a grand total of just 1 non-Japanese person. Though I assume he lives/grew up here since everything was in Japanese. Now mind you this was on a weekday (Friday) so I think there was a natural skew as to who could attend…

What was great to see, however, was that there was a decent amount of female attendees too! For an event, which is usually male-dominated this was refreshing. Age groups also varied widely here. I’d say about 20-25% of attendees were female.

Shareholder gifting

Another thing I noticed and found interesting was that this event had a whiff of …. capitalism shareholder gifting lol. There was a certain innocence to it all and was fascinating to see how the shareholder gifts were still at the forefront of many companies’ ‘pitches’. In the mini-presentations, they would have a section explaining what type of gifts you get as a shareholder. Some even told us how they re-instated specific gifts after they got a strong request from investors…There was even a booth highlighting all the shareholder gifts of companies attending. This part truly felt like a retail investor event. They even gave out freebies for attending their mini-presentations. Some were even using it as bait to come to their booth (lol) One even gave me a free electric toothbrush! Not gonna lie, I def joined in on the fun.

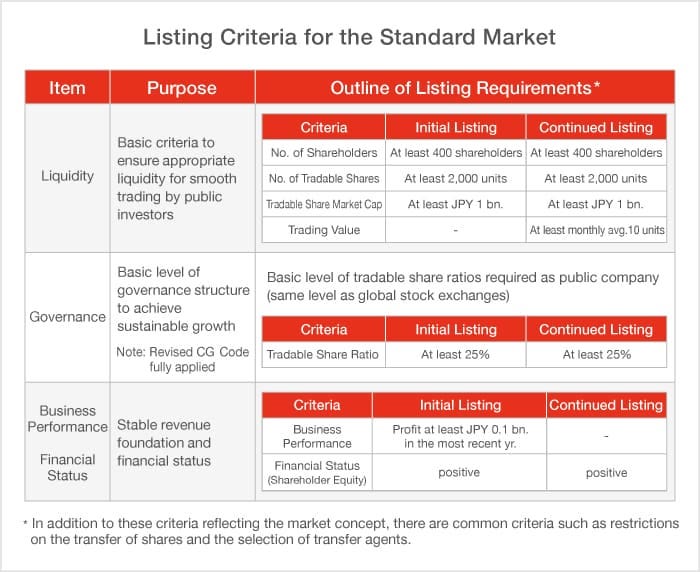

For those who are not familiar with the phenomenon. Shareholder Gifting called “yuutai” (優待) is a huge market in Japan today. It’s said to have started because companies wanted to ensure meeting the minimum threshold for the number of shareholders that’s required for listing.

Take for example the Standard market - which requires 400 shareholders.

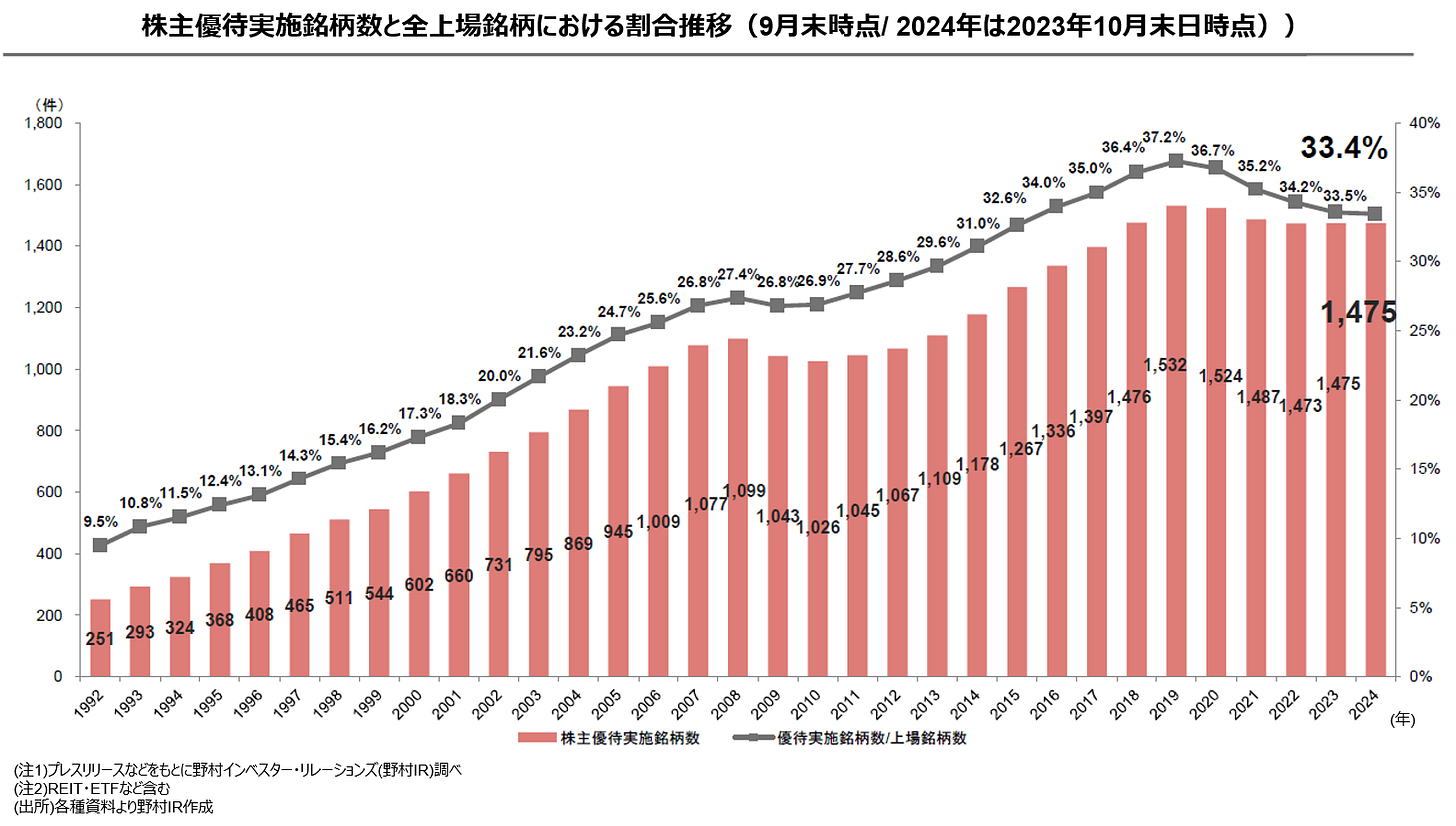

Today more than 1475 listed entities have a gifting policy according to Nomura. (I’m not sure if this only includes stocks or also REITs). There have been conversations along with the TSE reform that these giftings are not fair and that they can be costly. Firstly foreign investors can’t receive these gifts. Domestic asset managers also cannot use them as this could be considered embezzlement (since the use of these gifts comes from your client’s funds). In some cases, adding the value of the shareholder gift can add several percentage points to the dividend yield! It’s become accepted practice for local individual investors to calculate it this way. Some make a living out of it, like famed ‘Yuutai investor’ Kiritani-san.

Look at this recent tweet for instance. This company offers 15,000 Yen (Roughly $100) Quo Cards Semi-Annually just for owning 300 shares. At the time of the tweet, the ‘yield’ you’d get from these gift cards alone was a whopping 8.4%!

Gifts typically can be things like the aforementioned general use Gift Cards like “Quo Cards” which can be used across many stores. Others include physical gifts like food items. It’s a little better when the company gives a voucher to redeem from their store or service since the actual cash cost for the company is lower.

Some companies have stopped doing this, but the overwhelming feeling I had when I was at the event is that this type of gifting is here to stay. There have been companies that got sold off as a result of removing their gifting scheme. As you can see below the decline in companies abolishing this policy has also slowed in recent years. Call it a cultural quirk. In the end, not all of it is bad, but this is certainly a hidden cash cost for companies to remain as a publicly listed company.

To take the other side, the counterargument to having these gifts is that this can incentivize retail investors to potentially be long-term shareholders. Some companies only award these gifts to investors who’ve owned it for more than one year for instance. (I mean yeah, Long-term holders for all the wrong reasons but still). Also, it could be a way to promote one’s products or services by providing a gift related to it. It’s also tax-free for investors if the amount received is below 200k yen. Note that the amount of gifts don’t increase proportionately to the number of shares you own after a certain number of shares. So the more you own this will likely ‘dilute’ your yield.

Red bar = Number of companies that do gifting

Grey line = As a % of listed companies (including REITs and ETFs)

Ok went a little off-track here but the main bit…

Companies that caught my eye

These were businesses that I found interesting regardless of valuation (it looks cheap tho). As a general remark, it was also interesting for me to see the physical manifestation of investor interest in each company. Some booths were busy all day long such as kyoritsu maintenance (9616). So I didn’t bother going.

Funnily enough, at least when I was there, the most interesting companies were usually empty when I found them. Here’s some notes I took on 3 companies I enjoyed learning about and thought about looking into further.