Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclosure: The author currently owns shares in the company as of 11 August 2024. The security could be sold at any point in time without prior notice.

With a recent interest hike by the BOJ of a “colossal” 0.25%, the global stock market went into meltdown. The Nikkei and TOPIX have seen a record streak of declines presumably due to unwinding of carry trades and retail investors getting margin calls. (We had a record amount of shares bought on margin).

As the expectations for further rate hikes increased, naturally companies that were debt-heavy were also sold down quite a bit. One of which was Genda, a Japanese Company with the spirit of an American Capitalist I previously wrote about.

I thought this would be a timely opportunity to share some developments and thoughts on the company since we last discussed it which can be broken down into:

Business Progress

Share issue

Interest Rate Risks

Valuation

Business Progress

Since I wrote about Genda in February they’ve been seeing a rapid pace of acquisitions. 6 more in the last 5 months. Mostly in their mainstay arcade business and a Takeover bid for a listed company for their newer karaoke arm Ontsu - the 2nd largest karaoke equipment distributor.

A couple of points I’d note.

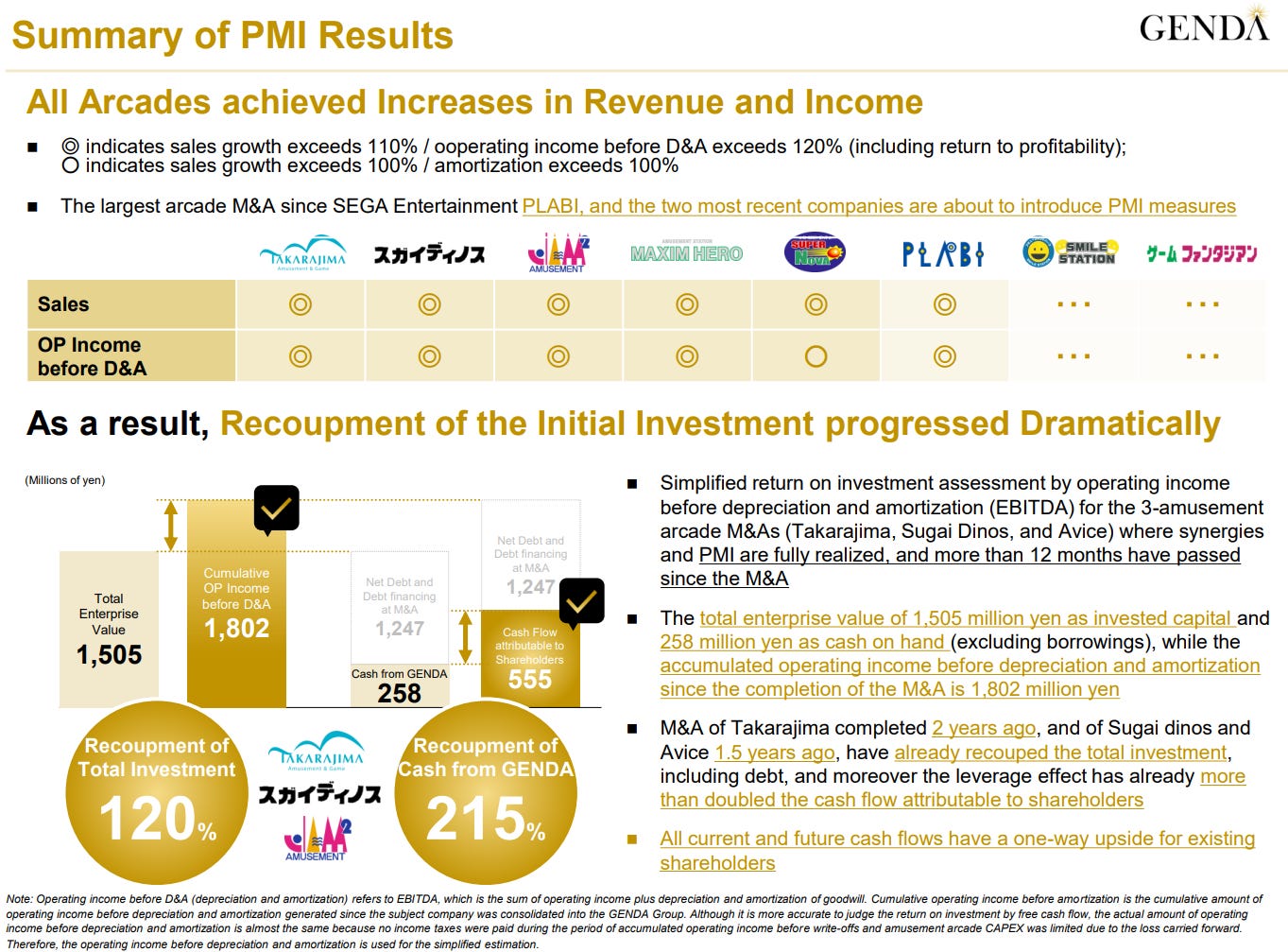

Post-merger integration (PMI)

Whilst we still lack data on some of their more recent amusement arcade acquisitions, they have quite clearly exhibited a strong capability to realize synergies for acquisitions on their platform. Seeing both above-market revenue growth and margin improvement. The acquisition prices paid were already low for them (typically low mid-single-digit multiples) - in reality, this means it was even lower - some had a payback period of< 2 years!

Whilst they don’t disclose multiples paid for all of their acquisitions they have disclosed a few of the recent ones, which all seem to agree with what they have been saying that multiples they’ve been paying are low:

National Entertainment Network: 3.6x EBITDA

Ontsu: 5.6x EBITDA

C’traum: 1.8x EBITDA

Clear Communication

Their communication, especially among listed Japanese biz’es has been exceptional. Clearly the CFO and CEO’s background at Goldman is serving them well. Things that I think have been extremely helpful to investors are:

Their monthly Q&A Release clarifying frequently asked questions.

Discussion of Acquired Businesses.

Even in their earnings presentation they provide detailed information on the progress and thought processes of their acquisitions.

Most importantly, all in English - it’s clear that this has been appealing to an international audience. (Capital group recently filed >5% ownership).

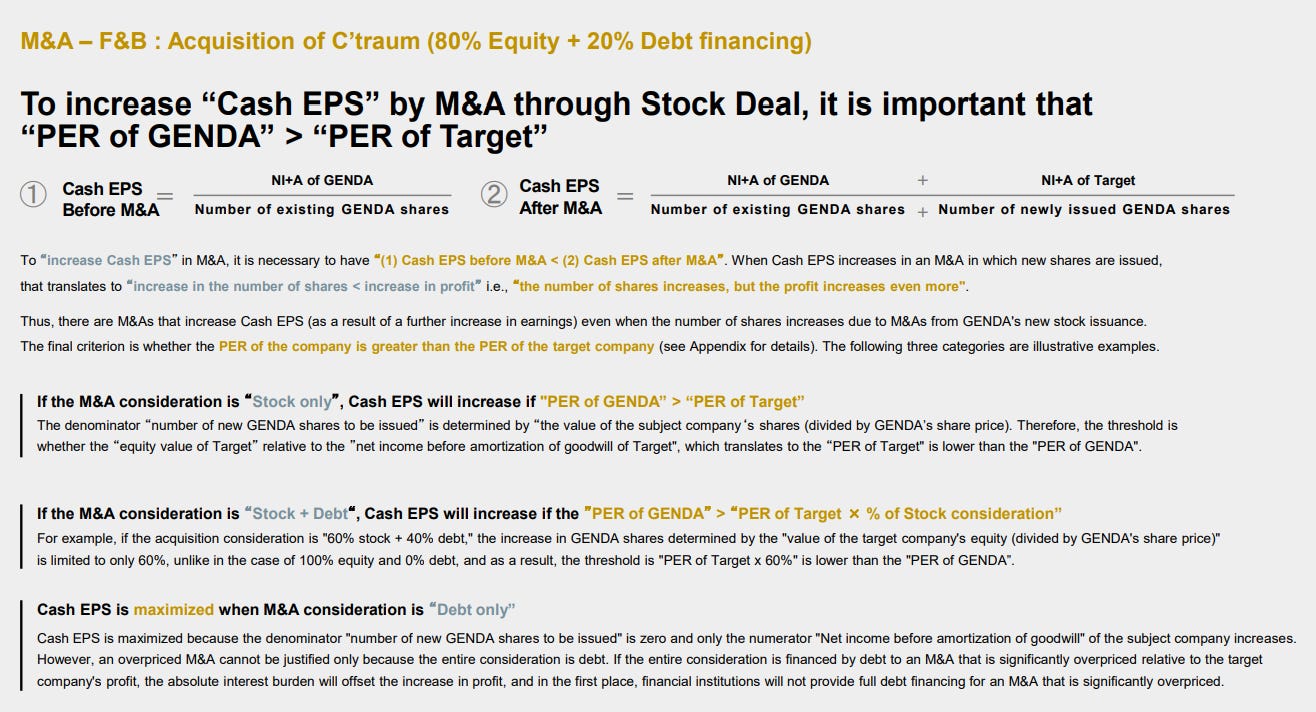

I especially liked the slides that show they understand the cost of capital. Look at when they paid for their acquisition of C’traum through newly issued shares. It’s probably the first time I’ve seen such a slide from a Japanese company. In fact, this was an interesting transaction as they used their shares to acquire a net cash company trading at a multiple way below what Genda was trading at (Reported 20.9x P/E compared to 5.9x). They’ve even called this a ‘quasi-equity financing’ and seems like a smart move.

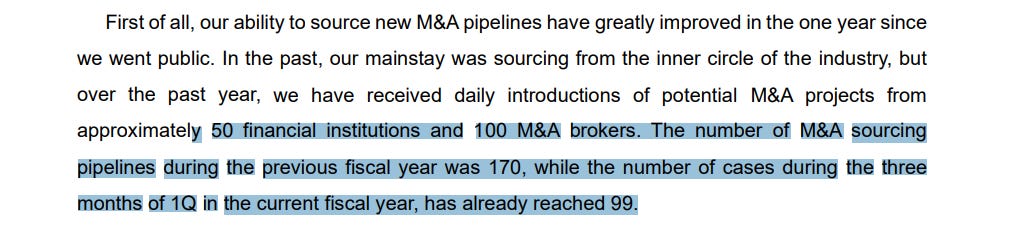

M&A Pipeline

Finally, based on their recent press, their acquisition pipeline appears to be as rich as ever. They are no longer as reliant on the Management’s network alone. It’s also likely that the impressive PMI performance they’ve exhibited so far has given them strong credibility as the preferred acquirer. (Signalling the owners that they’ll improve your business) [Side note: 100 M&A brokers? Sounds like a pretty competitive industry …]

The wild card is their US presence now through their acquisition of National Entertainment Networks.

On one hand, I’m usually not excited about Japanese companies making acquisitions abroad. On the other hand, I see the potential opportunity and synergies here.

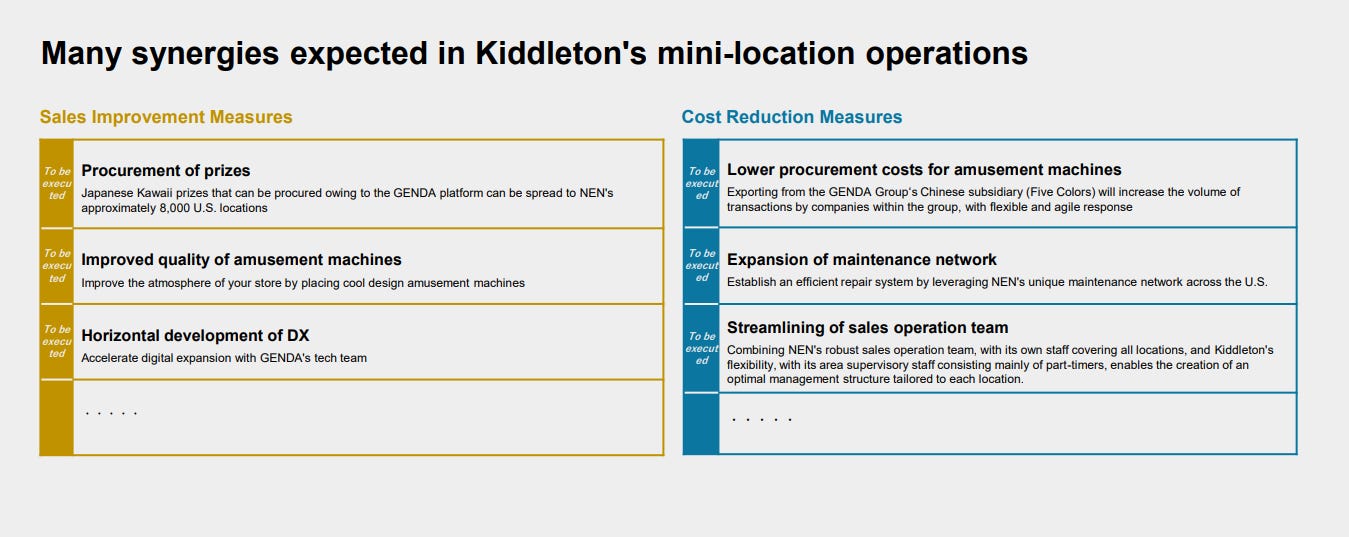

In the US, Genda already had some presence through their Kiddleton mini locations through this acquisition they’ve obtained:

a footprint of over 8000 locations (For context, Kiddleton has 500)

Business partners with major chains they didn’t have previously such as Walmart, Denny’s, Kroger and etc.

They see the opportunity to replace the prizes from American toys with Japanese “Kawaii” toys, a growth trend that Genda can ride as Anime culture continues to spread abroad.

I think it’s somewhat de-risked by the fact that the multiple paid was 3.6x EBITDA (based on 12/2023 figures). Furthermore, as someone I know rightly pointed out this deal has not closed yet all to say the JPY has strengthened by 7% since announcing the definitive agreement, and thus on a JPY basis, their acquisition price may end up being cheaper.

Also note that even for the international acquisition, it was fully financed by JPY debt.

So to me, the odds of this working out are a little higher than what I’d normally expect from a Japanese firm here. There are several members of the board/management that have international experience within this industry as well.

And the upside here could be absolutely massive. Genda’s Kiddleton is generating 3x more revenue per store than NEN. Implying that if they manage to improve the NEN this can grow materially from current 100m USD (15b Yen) revenue. Obviously let’s not assume Genda will 3x NENs sales but even if they do a portion of that it’ll be meaningful.

Furthermore, another component I feel is underappreciated is just how profitable this could be. Competitor Round One’s EBIT margin in the US is close to 20%, for context NEN’s Pre-synergy EBIT margin is only 3%. (see appendix for insights on the US)

By the way if you want to bet on a US expansion story - Round One itself is also a potentially interesting idea worth looking at. Continuous Compounding wrote a piece on his substack.

Share Issue:

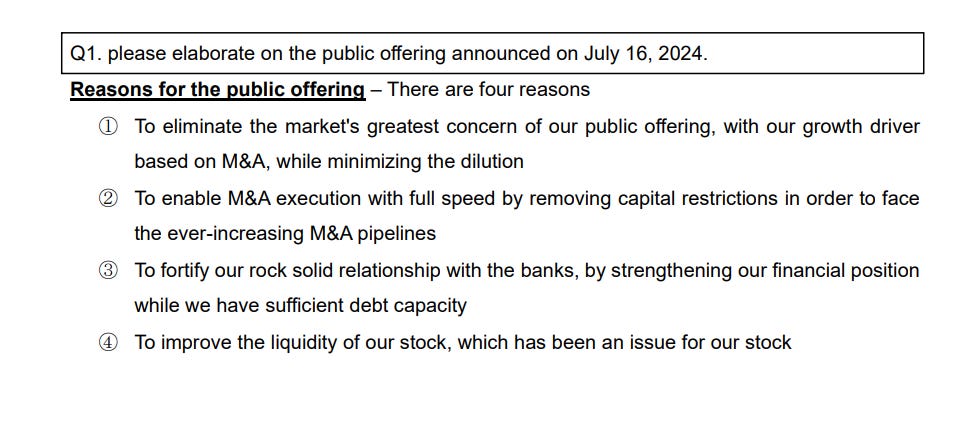

In July Genda also raised capital through a primary offering to international investors, which saw strong interest. In the days following the announcement, the stock was barely down.

Again they’ve laid down their reason as to why. Dilution is not an issue if you can raise capital at a P/E of 29x (LTM EPS) and allocate it to acquiring assets at a mid to low single-digit multiple. I was told by another investor recently that Genda is apparently seeing opportunities trading at single-digit P/E. So such a capital raise should be highly accretive to existing shareholders as well.

Interest rate risks

One of the main risks to the thesis is Genda’s ability to obtain cheap financing, which is their main fuel for acquiring business at low valuations. This is especially because most of their debt is at a floating rate. Now I give them credit for clarifying this on the day the market was turning down heavily (It traded around 1310 yen at that point). The risk from an increase in interest rate is not as large as it may seem.

As they explain post-closing of their NEN and Ontsu acquisitions their interest-bearing debt will be 50b Yen. In the unlikely event rates rise by 1% the additional impact on guided EBITDA of 13bn is only 3.8%. Two things to think about here:

guided in italics because this is arguably too conservative. They made this guidance before the 5 recent acquisitions and also stated that they don’t assume any additional M&A in their forecast. So in reality the interest rate impact on EBITDA should be even smaller than what they mentioned in the release.

We just saw what happened after a 0.25% hike in the markets and the following communication from the BOJ, makes it highly unlikely for such aggressive hikes any time soon…

There are a couple more reasons IMO the risk of this is not as high as it may seem.

Not all of the debt is floating, some are fixed.

They have 40+ banking partners to obtain financing from, they’re all competing for yield which means some of the increase can be offset.

Genda owns cash-generative assets which can de-lever the biz quickly.

Furthermore, when rates rise, it’s not just Genda that’ll get hit but the businesses that Genda’s trying to buy, I’d expect valuation multiples to decline for those too which offsets some of the risk as well.

Valuation

I honestly think it’s not that useful to build an extensive model for this business given that, acquisition cadence and ensuing balance sheet structure is hard to predict. (although presumably almost 100% of the acquisition is financed by debt).

But to get an idea, here’s my napkin math:

Genda has not officially raised guidance for the full year, this is not very useful anyways since they don’t assume any additional M&A here. This is despite them saying Q1 results fared better than expected.

So including the acquisitions they’ve made since giving guidance (I assume the NEN and Ontsu deals close) here are my assumptions based on data they’ve shared through some releases:

EBITDA: 13b guidance + 3b from acquisitions = 16b run-rate NTM EBITDA

Cash Balance: 18b Yen + 10b Yen from recent Issue = 28b Yen*

Interest-bearing debt: 50b Yen*

EBITDA to FCF conversion of 60%. (They said 70% some time ago but for safe measure)

Based on this I get a FCF yield of 7.2% on a fully diluted basis. (Conversely a FCF multiple of 14x).

Even then I think this might be conservative, for a couple of reasons:

Consider how they’ve handled the PMI processes so far, which saw both an acceleration in revenue growth and improvement in profitability.

Already annualizing Q1 results they’d comfortably hit full-year targets - and the peak season is said to be in Q2. 2 potential factors I think may drive higher-than-expected sales in addition to strong PMI are a) Record inbound tourism (Anime/game arcades is a global phenomenon) and b) Abnormal hot temperatures leading to more people spending their free time indoors.

With the new equity issue, I estimate their current Net Debt/NTM EBITDA to be 1.3x. However, they’ve mentioned they're looking to lever up to 3x at some point which would conversely mean there’s further room for cash-flows to be acquired. With the 10b equity raise, they expect to be able to raise a further 55b* debt to get to their optimal levering. So they’re sat with an additional 65b yen in their war chest. Using Genda’s assumption of a typical acquisition multiple of 5x EBITDA, that means an additional 13b in EBITDA can accrue to shareholders through M&A with the current balance sheet structure.

(They’ve even given the maths in their recent press release, and almost sounds like they already have acquisitions ready to close). This is before assuming any margin/revenue improvements from their existing units and any de-levering.

The 7.2% FCF yield looks pretty interesting by itself if you consider the organic growth and potential margin improvements, but with the additional acquisitions that could materialise due to further levering (of cheap debt) we could potentially see an explosive growth in earnings that accrue to the shareholders.

*Based on what is disclosed on their August FAQ.

Appendix

There was some interesting anecdotal evidence that the tailwind of Japan’s cultural exports namely anime and game arcades look promising. (Both home and abroad)

Major Convenience store chain installing crane games

The Mainichi reported that Lawson, one of the big 3 convenience stores will be installing crane games across 1000 stores. With Lawson commenting that "The fact that the prizes are products that are not sold in the stores and the affordable price of 100 yen (approx. $0.64) per game are attracting customers."

Which kind of confirms one of Genda’s main strengths which is product exclusivity. Also with the affordability of price potentially points to some resistance to recessions due to it being such a low wallet share for consumers.

Will Lawson become a risk to Genda? I think the risk is low, given a convenience store format there are only so many crane games you can install without cannibalizing other products. Genda also likely has a better portfolio of prizes they can offer. One wild guess is that maybe Genda might even be the ones selling these crane game equipment to Lawson. (I’m not sure)

We even have a term in Japan called Oshi-Katsu(推し活) which is a combination of two words. Oshi(推し) and Katsu (活)which can be loosely translated to Support and Activity quite literally. (So no I’m not talking about the delicious Katsu you can eat). Oshi-katsu as a term means more like “supporting your favourite”. Expresses fandom for a particular anime, character or even real life celebrities (musician, athletes etc).

This is something not to be underestimated, fans will frequently send actual gifts to the person through their talent agency or gyms where athletes train. As one executive in the music industry told me, “you should not underestimate how dedicated these fans are to these musicians, it is almost like a religion”.

Billie Eilish in Japan (and in a Genda Arcade)

Another fascinating peek into the growing cultural export of Japanese game arcades was when global sensation Billie Eilish was captured at one of Genda’s gigo arcades upon her visit in Japan in an interview with Japanese Rapper VERBAL. This first aired as a news segment shared by the Genda Chairman on X, later followed by the full interview on Complex Magazine. The interview is fun to watch but to me its more so that this moment represents how Japanese Anime and game arcades are starting to enter the mainstream.

The Rising interest of Japanese Anime culture abroad

One of Genda’s competitors Round One has been building a presence in the US for some time now.

Profitability in the US could be significantly higher than Japan, according to this Bloomberg article and Round One sees just how profitable crane games are too: “the company’s most lucrative offerings are the claw machines, where patrons spend about $2 a pop to try to snag toys tied to popular anime properties. The company is increasingly repurposing space it had dedicated to video games for more claw machines, in an initiative it’s dubbed “Project Mega Crane.””

Another comment I found interesting: “Copyright restrictions make exporting Japanese arcade machines surprisingly tricky, and their presence means Round One can count on ravenous gamers traveling from hours away, leading to a festive atmosphere that sparks curiosity among newcomers, too.”

Pointing to the potential barriers to entry for an American counterpart to participate in their own home market.

Welp, that’s it for today folks, thanks for reading! Whilst this isn’t really a new idea per se, I previously thought the opportunity wasn’t that asymmetric. Today, with all that they’ve managed to achieve thus far, I’m a little more confident in management and I think it’s time to start looking closely again.

(As always, please make sure to do your valuation maths!)

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclosure: The author currently owns shares in the company as of 11 August 2024. The security could be sold at any point in time without prior notice.

Do you know how RoundOne's sales per store in US compares to Genda's JP stores? Could be a way to see how much PMI Genda can achieve