Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. It may include some errors, please make sure to do your due diligence. The opinions expressed are those of the author and are subject to change without notice.

Disclosure: The author currently owns shares in companies mentioned as of 24 May 2025. The security could be sold at any point in time without prior notice.

Well well well, it’s been a busy few weeks with earnings season again. We’ve had quite some earnings come out last week, so time to reflect on the main ones…

CYND (Ticker: 4256)

Solid execution on Beauty Merit

Impressive margin expansion for Kanzashi, but slowing growth was negative

Strong net Income growth in FY24 and better than expected in FY25.

I made this short-term bet that the market will react positively to the strong EPS growth. Well, that uhh… didn’t happen. I mean the Net Income growth part did, and in fact, FY25 Net income looks better than what I anticipated, but the stock was down *checks notes*…-9% on the day.

But hey, let’s remember that this thing started running up a few days prior, seemingly in anticipation. So net, it’s up about 19% when I wrote abt it, so can we call it a draw?

In all fairness, I thought the overall earnings were fine!

At the group level, revenues came right in line with CYND’s full-year guidance. EBITDA was slightly better than expected, exceeding guidance by 5.7%. Let’s break this down by segment.

Beauty Merit:

Overall, this core segment reported solid results. Q4 revenue growth was 14%, as was ARR. Customer growth slightly accelerated over the last 12 months, too. Nothing to write home about.

On margins, Q4 EBITDA margin was 24.1%, which was lower than historical margins around 29-30% and even compared to Q3, where a chunk of the office costs were booked. This meant that EBITDA was down -10.9% YoY. Now, as alarming as that may sound, I don’t think it is. As I’ve mentioned before, I think the increase in approx. ¥5mn in monthly rental costs translates to roughly ¥15mn increase in operating costs per quarter, and this was likely booked in the BM segment. Recall that in Q3, Group EBITDA already reached 81% of guidance. With the high visibility in revenues, I believe management decided to spend any profits significantly exceeding FY24 forecasts for growth. I think this would be a better option, thinking about the business over the long term. They’ve even mentioned that they’ll invest in personnel/growth already in their Q3 material.

Looking forward, this year they’re expecting a year of decent growth for BM, +14.7% for sales and +16% for EBITDA, respectively. Again topline looks like business as usual, but I’d love to have seen some more operating leverage here. I think they’re being conservative.

Kanzashi:

For Kanzashi, it was almost the opposite. One negative trend that we saw was that Kanzashi’s revenue was decelerating. Between Q1 to Q4 YoY ARR growth decelerated gradually: 23.6% → 23.1% → 18.9% →18.5%. Furthermore, they’ve issued guidance expecting further deceleration in sales, guiding +16.4% this year. (More on this later). Ultimately, it’s a smaller portion of CYND’s business, but enough to sting. It certainly doesn’t help them make the case for what’s already considered a controversial acquisition by some investors.

The counterargument lies in the margins they’ve reported, though. Q4 EBITDA margin was 18% for Kanzashi, which is impressive considering that the business was at break even less than 24 months ago. Their full-year EBITDA margin was 17.3%, which is well above the 13.7% they were aiming for. I think that Kanzashi might’ve focused too much on profitability over growth, which feels too early at this stage, given the latent market opportunity. Their guidance seems to show they’ve realised this, accounting for slightly lower margins YoY in order to invest and strengthen their sales structure. (My pure speculation is that they might’ve tried to flex their profitability in the past year in order to reassure they didn’t just buy a loss-making shitco, especially now in a climate where profitability in SaaS actually matters)

One smart thing I thought they did was that they’ve started reporting Adjusted Net Income, which is essentially a cash earnings metric that adds back the amortized goodwill/intangibles to net income. This may help investors realise over time what they’re actually earning in cash, and not the amount that’s being unfairly punished by J-GAAP. We shall see…

Look, in an ideal world, I’d love to see some new catalyst here. Though I’m not counting on it, there a few I think could materialise.

CYND is highly cash generative and growing at a solid rate. Their net cash position is growing quickly. Whilst they’ll need some of this for growth, I don’t think they need all of it. So there’s a chance they may initiate shareholder returns, which in turn may drive some interest for the stock. Given the liquidity and listing requirements to have >25% float, the natural option would be to pay out dividends for now.

Exceeding restuls expectations may also help the stock. This includes if we see a meaningful re-acceleration in BM and Kanzashi’s revenue or earnings. Historically, CYND has consistently beaten their own EBIT/EBITDA forecasts.

Even without any catalysts, however, underwriting 15% EBITDA growth for the next 3 years, which I think is achievable, the implied EV/FCF in FY27 will be 6.5x. EV/ARR will be 1.2x. If they can achieve this, I think the undervaluation will sort itself out.

Ultimately, I’m satisfied with their numbers. I will watch how the growth of Beauty Merit and Kanzashi develops with interest, this is key IMO.

Some questions I have outstanding:

They’re only targeting to get to 23,000 total customers by FY end, which is a growth of 11% in customers YoY. This is lower than the actual revenue growth guidance - I’m not sure what this means.

The economics of their new product BM Smart Mirror. This is some cyberpunk mirror which looks neat, but I have no idea what this entails, including what kind of capex and investments will be required. I see this as a free option for now, and not counting on it for growth

Has the thesis changed? No.

Any actions required? No, if the business continues to deliver good earnings growth. Looking out for how growth develops for both BM and Kanzashi.

Alpha Purchase (Ticker: 7115)

Facility management (FM) was weak again due to a lack of large projects in Q1

The key MRO segment was impressive, with operating leverage now visible

Announcement of a Mid-Term plan (!!!)

Honestly, nothing much to write here other than to say that FM sucked as usual and due to a tough comp base with a lack of large projects YoY. Margins also took a hit as a result. Revenue and EBIT margin were down -9.3% and -27.7% respectively. The weaker margins were also partially due to them setting up their new AP Renovations entity under FM which meant there were added SG&A costs.

Nonetheless, the main MRO Segment was good. Revenues were up 11.2% with a continued uptick in new users and spend from existing ones. This seems to be tracking above what they’ve guided for this year. Another positive was that their SME sales via Askul are turning the corner and is now starting to show some improvements after 12 months of weakness. EBIT was up +69.4% YoY, showing that operating leverage is finally starting to kick in - a core component of our thesis. With the segment being the main driver, this more than offset the weakness in FM and drove group EBIT to be up +34.5%.

An interesting nuance mentioned in the earnings call was that since marketing their catalogue component as a separate product called ‘Mugen catalogue’, they’ve seen strong interest. In particular, the use of their recommendation engine - a function which automatically compares prices across multiple suppliers for the same product and recommends it - saw better than expected use. Counterintuitively, because customers will then choose the cheapest option, it becomes a deflationary pressure for AP’s MRO sales because revenue is on a GMV basis. So they’ve achieved 11.2% growth despite that discounting. On margins, this means AP aggregates demand from multiple users into larger order lots, which in turn means that they can procure cheaper from suppliers, and this acts as a net positive on margins for AP.

MT plan

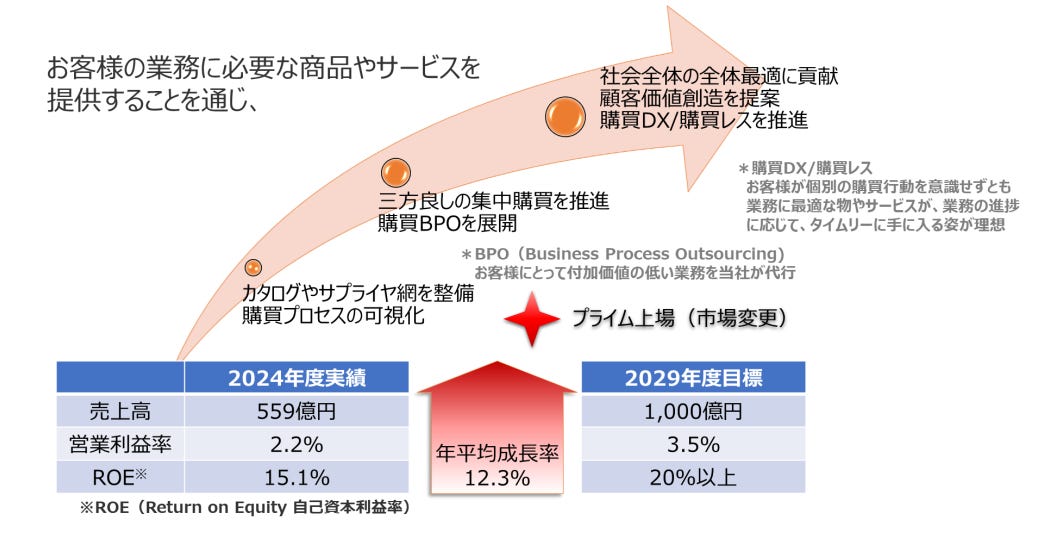

Perhaps the most important piece of news was that they’ve finally come out with something of a medium-term plan which I’ve written in the past would come some time this year and it finally did. What’s great is that they’ve given a 5-year target. Revenues of ¥100bn and EBIT of ¥3.5bn, implying a 12.3% revenue CAGR and a 23% EBIT CAGR!! Until recently, it was trading basically at 11x P/E for this thing lol. Sure, it’s doubled since but I don’t think it’s expensive on the grand scheme of things. Especially if they can achieve this. One major point to note is that the business used to unofficially see 2030 as the year to achieve 100bn in sales, and this is now officially pulled forward to a year earlier. This would be a good moment to remind you that management have proven to be careful, conservative folks, and for them to have come out with such targets with measurable goals makes me believe they see this as something that they can achieve with a high probability.

Although not new, their stated intention to be prime listed is also positive. In doing so requires AP to increase their market cap, which in itself is aligned with shareholders’ interest. Moreover, once they achieve this, it should become a lot easier for institutional investors to participate, which in turn should improve the liquidity.

Risk factors:

That’s not to say there aren’t any risks, though. One thing that I picked up worth thinking about is that there could be an indirect impact from the whole Trump Tariff stuff. Whilst this likely won’t impact MRO demand, it appears conversations with some customers have stalled as a result. Sales cycles can be very long for APMRO, so this could bite them at some point in the future.

Has the thesis changed? No.

The stock’s rise is the type of development you could hope for. Some of the catalysts we discussed previously are now kicking in. The business was priced as if it wasn’t going to grow, but this quickly changed once the company guided for margin expansion. They’ve even announced an MT plan with a 5-year Revenue and EBIT target as we’d hoped! Furthermore, this one seems to have foreign institutional participants come in early and has helped the company re-rate to a more appropriate valuation. So a lot of the initial catalysts I anticipated are playing out. Now they just need to show they can execute.

Any actions required? No.

I’m a happy holder for now, who will be cheering on their execution. Q1 was great, but they need to do this sustainably over time.