A peek into Japanese Roll-ups

Could Genda give us a glimpse into the future of Japanese Capitalism?

As Japanese Capitalism enters its next phase of transformation, I’ve been spending more time assessing the potential for Private Equity opportunities in addition to stocks.

Why? The combination of low-interest rates and low acquisition multiples can result in a very high IRR.

A key trend is consolidation (M&A) across various industries whilst interest rates remain low vs RoW and as the aging population leads to a wave of succession planning. But the situation is so dire that businesses are having to close down because they can’t find anyone to take over, these are in effect forced sellers. Yet, the tide seems to have turned on the idea of M&A with the stigma slowly being forgotten and now becoming a very real option for business owners as part of their succession plan.

This has led to both domestic and international entrepreneurs looking for ways to take advantage of this opportunity. For many, however, lacking access to financing and the right network, this has been a futile attempt.

But what we’re starting to see now is that there are some interesting ways to bet on this change in the stock market too. One company that might give us a glimpse of what Japanese Consolidation may look like is Genda. (9166.JP)

Genda is probably one of the first listed companies in Japan to proclaim itself as a roll-up with a rather big hairy audacious goal - They are aiming to become the number one entertainment company in the world by 2040.

For now, it is mainly focused on consolidating the amusement arcade industry, known as Game Centers or ‘ge-sen’ in Japanese. The most common games that generate profit are known as prize games/crane games which many of you (or your kids) might be familiar with.

If you’ve been to Japan, you’ll recognize the stores with the big GiGo Signs.

Market Opportunity

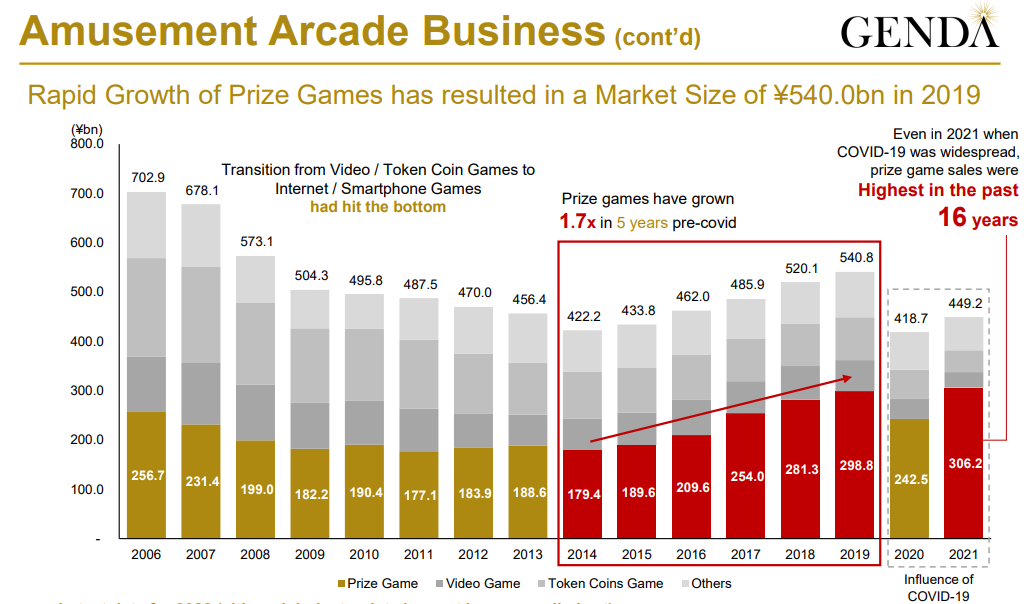

The Amusement arcade industry in Japan is worth 540bn JPY and 60% of the market is fragmented! The market itself is mature and only growing by 1-3% a year.

It was in decline up until 2014 when things seemed to have turned. One thing that seems to put the industry back on a growth path was the growth in the Anime industry both domestically and internationally. These are becoming valuable channels for fans to win more limited-edition merch available through prize games. It’s also a form of cheap, interactive entertainment. Note that the Prize Game subsegment has been driving growth since 2014.

Moreover, this type of arcade experience is still a small market overseas but has been growing, which in turn poses an opportunity for Genda. Its Kiddleton subsidiary for instance is focused on opening ‘mini-sites’ in the US which are unmanned and do extremely high rates of return.

The main attraction for this is that it is a highly cash-generative business. It has little variable cost with the main costs being fixed such as lease, floor staff, and depreciation of game machines.

M&A Strategy

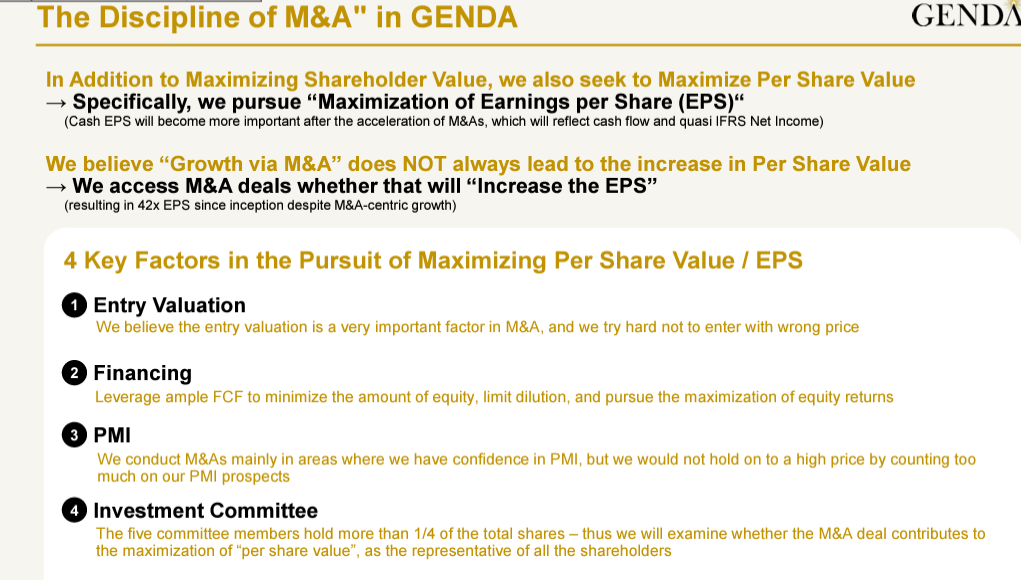

What I like is their explicit focus on increasing Per Share Value, which is a breath of fresh air to see in Japan and is also a pre-requisite for a successful roll-up.

Their idea is to purchase assets at a low valuation before any synergies are realized. Pre-IPO they’ve been purchasing businesses at close to 2x EBITDA on average, combined with debt financing at ultra-low rates have resulted in an insanely high IRR. (apparently close to triple digits).

Make no mistake, I think the IRR will come down as it scales, and acquisition multiples paid will likely move towards to 4 or even 5 times as targets get larger. That said, with financing costs being so low, some organic growth, and pretty good industry margins (15% EBITDA) they should be able to enjoy a handsome IRR for some time.

Post IPO in August their Net Debt/EBITDA was 0.2 times providing them plenty of capacity - even today after all the acquisitions it has made, it is at a modest ratio of 1.5 times. It’s also worth mentioning management is not looking to compromise on the quality of business it acquires. That is, they aren’t looking to buy cheap crap.

A key strategy they mention is to generate cash on cash returns and not simply achieve revenue growth.

New Verticals

Until recently, Genda has focused on acquiring game arcade operators and related businesses but has been upfront about entering other verticals in the name of becoming an entertainment giant. This has been happening fast. For instance, we’ve already seen them acquire a company called Gaga and LEMONADE by Lemonica. Gaga is a leading film distributor in Japan and Lemonica operates a chain of Lemonade stores throughout the country. To be honest it was quite surprising to see Genda already approach such different businesses. Most recently it acquired Shin Corporation which operates a Karaoke Chain operating over 372 stores.

With these acquisitions though, IR communication has been outstanding for a Japanese company. For example, they immediately put out this press for its Karaoke Chain acquisition as a rationale. In previous releases, they have been able to explain the group’s strategy and approach quite well. You can view them on their IR page.

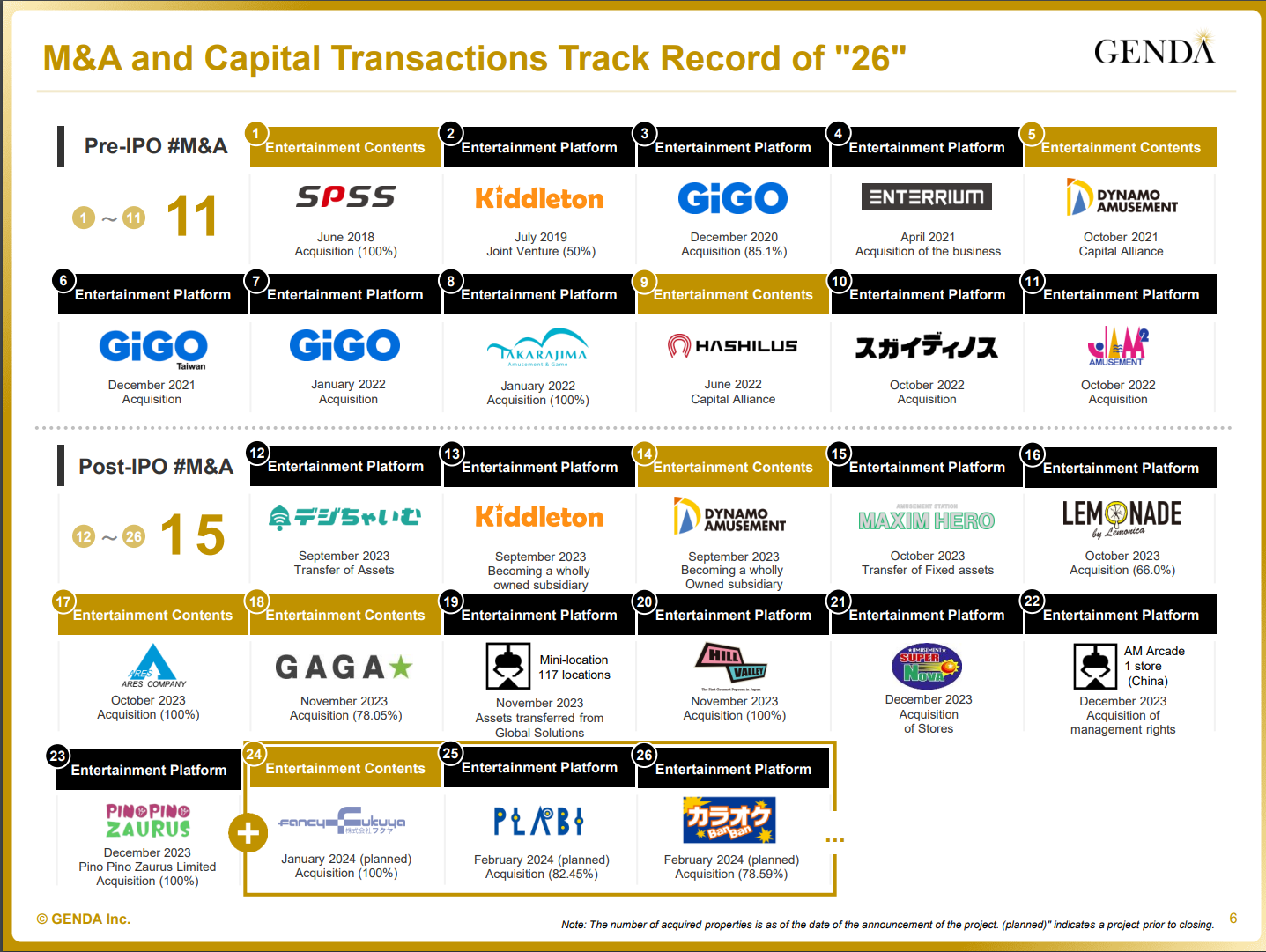

As you can see Genda has been acquiring businesses at breakneck speed. Perhaps too fast. In the 5 months since listing, the company announced 15 acquisitions. Which is markedly faster than the last 11 acquisitions since founding done over 4 years. Though it’s hard to be certain one factor that likely contributed was the inability of Genda to do any M&A in the pre-IPO process (lasting 6-12 months I believe) so there was likely some catch-up. In Japan, the prestige of being a listed company also likely convinced some tentative sellers to approach the company.

The opportunity seems to be ample, having targeted to source 50 potential targets in 2023, it ended up sourcing 102.

In terms of Genda’s thought process, they categorize the acquisitions into two pillars. One is entertainment content that is, businesses that have certain rights to IP for merchandising. The second is the entertainment platform, the channels in which licensed merchandise reaches the customers.

Synergies

Back to amusement arcades and Genda’s current portfolio. There are still some low-hanging fruits for synergies and it’s not rocket science. For example, its scale gives them the resources to license IP for their merchandise (e.g. anime characters) and for cheaper. Thus the quality of prizes is higher. Typically smaller operators do not have the budget nor the scale to do this leading to lower quality prizes. With Genda’s scale and resources, they also ensure each site’s facilities are up to date with a clean look and can procure these physical gaming machines for a lower average price.

Genda also uses its resources so customers have a more digital experience. It can be as simple as enabling digital payments on these coin-operated games. This seems to meaningfully increase the average spend per customer.

Overall there are some loose synergies.

Moreover, they are currently implementing a real-time system to identify which games are giving away fewer prizes. In doing so this prompts floor staff to make it ‘easier’ for the customers to win games. Why would they do this you might wonder? Management prefers that customers end up winning something after spending some money (on average $20) to incentivize customers to return.

Below are examples of sales growth post-acquisition of some of the smaller industry players.

Though overall, the synergies among each acquisition are not likely to be huge, once these low-hanging fruits are gone, or at least not entirely clear. One interesting example though is by having a GiGO arcade and fanfancy+ (a character merchandise store), they saw sales per square meter 3.7 times higher than a standalone arcade outlet.

Management

What’s fascinating to see in this young company is that it’s stacked with experienced personnel. This is perhaps one of the main strengths of Genda as an investment opportunity, especially given its roll-up strategy. The management is a combination of entertainment industry veterans and those trained in ‘Western’ Finance via Goldman. The Chairman, Nao Kataoka is an industry heavyweight having led Aeon Fantasy 4343.JP until 2018 the same year he co-founded Genda. His track record there is remarkable as is visible by Aeon Fantasty’s stock where he helped the firm to successfully expand domestically and overseas. The stock has dwindled since his departure.

The other co-founder/CEO was previously at Goldman Sachs Japan and trained in traditional ‘Western’ finance and in a position to better understand capital allocation (as is the CFO, who is also an alum). The CEO’s resume is also impressive having worked at Goldman Sachs previously and becoming one of the youngest MDs, only to leave in less than a year to take the risk to start Genda. This synergy of Finance X Deep industry expertise should help improve the odds of this strategy succeeding.

Not to mention, management has skin in the game with the Chairman, CEO and CFO each owning 16%, 6%, and 1% respectively. So they have every incentive to focus on making EPS accretive acquisitions. (note that the lockup period expired 24 January 2024.)

With the rest of the management team, we see former execs of major competitors such as Sega Sammy and Bandai Namco operating as divisional heads. Specifically, after the Sega Arcade acquisition, the president stayed on as Chairman at what is now called Gigo Entertainment. The president of GiGo entertainment is the former Executive Officer of Bandai Namco Amusement, a large competitor. In aggregate, the members have experience in expanding operations abroad with deep industry expertise. In an interview, the CFO makes clear these execs (including the Chairman) with deep industry experience provide the main deal-sourcing network (See here in Japanese).

On the board too, the former president of Square Enix has a role as an independent director further beefing up the reputation of the management and board.

One aspect I believe will be paramount in succeeding with a Roll-up strategy in Japan will be the quality AND reputation of management. Just like you’ve seen with many public companies that are ‘stakeholder focused’ in Japan, private companies are too. This means that piling up enough cash isn’t necessarily the deciding factor, owners want to make sure there is continuity after the sale in aspects like retaining staff. Most owners do not want to see the business being gutted out. This leads to the next point.

Competition and being the Acquirer of choice

Money is a commodity in the end and there’s lots of it in waiting idly to be deployed in Japan, so why does Genda get the deals?

Genda in its short period of existence has built a reputation in the industry – this was on the back of the Chairman, who was CEO of a top 4 player so no surprise here. In 2020, after only two years of existence, it struck a deal to buy the game arcade franchise from behemoth Sega Sammy which is a listed 4 billion dollar market-cap business. It is telling that Sega was willing to sell a cash cow business during the height of covid to a relative minnow.

Competition from the other large arcade operators has been minimal. This could change of course - but the reality is that many of the others are part of larger organisations and merely seen as a cash cow. Neither has M&A been on their growth agenda and apparently, they are reluctant. (You can imagine the bureaucratic nightmare of passing through an M&A proposal in a large Japanese enterprise). As a comparatively small business relative to the parent organization there has also been little incentive for HQ to invest in its growth. This is where things could also get interesting - I understood there is a possibility a major competitor could sell to Genda - which will make it by far the largest operator in the market.

Would Private Equity be an interested competitor? At this point, this seems unlikely. Genda is now at a scale and built up a reputation where – if Genda says no to a prospective deal most other buyers won’t even touch it. This comes down to the difference between an evergreen approach by that of Genda (again, acquirer of choice) versus PEs which require an eventual exit. Funnily enough, in such a niche industry, Genda, as the sole buyer in many cases is the only viable exit! So if Genda won’t pay up that price, they sure as hell won’t after a PE bids it up.

This provides Genda with significant negotiating power.

To summarize what we’ve talked so far

Let’s use Paul Andreola’s ‘Keys for a great roll-up’ which I thought was fantastic (can be found here)

Targeting a fragmented Industry: 540 billion JPY, 60% fragmented.

Boring Business: Yes, mature market growing by low-single digits.

Capitalize on industry succession challenges: Yes, this is a macro issue in Japan. Genda has a strong case for being the ‘acquirer of choice’.

Financing as a strategic tool: Their core thesis is to take advantage of low fixed financing rates at high LTV whilst focusing on EPS growth.

Value-minded/Thinking arbitrage: So far average multiples paid have been low single digits.

Deals that make sense from day one: Genda is looking to get a high IRR before any synergies. However, early entry into new verticals puts a question mark on how much some make sense from day one.

They move Fast: Yes but perhaps a little too fast. 15 acquisitions in the last 5 months.

Through this writing, I hope you enjoyed learning about a niche-sounding industry that’s pretty big in Japan! I wanted to share this to tell the story of the SME M&A opportunity but also from a quality of business standpoint for the stock investor. Initially, I wrote this as a long idea, procrastinated, and since has moved up quite a bit. Whilst there is a potential upside from there the risk/reward today is less asymmetric. I’d mention that whilst it doesn’t look expensive compared to other roll-ups, I think it’s because many aren’t sure about the track record, given it’s still so early in its Journey and also average multiples in the entertainment sector have been generally lower.

In part 2 we will be covering more of that in detail including valuation, previous acquisitions, financing structures, and key risks.

Thank you for your time!

Disclosure: I am long and still hold a small position.

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your due diligence.

Thanks for the write up, learned a lot. I was looking into competitors of Round1 as I did a stock pitch on them recently. Saw your pitch being shared by stock analysis compilation and glad I clicked. How do you think Genda compares to Round1? Also, in terms of valuation, what would you say is a good entry point to start buying? What is a fair valuation for Genda?

Keep up the good work!