In Part 2 we’ll cover some more on Genda’s acquisition strategy related to financing, past acquisitions, key business risks as well as valuation.

Past acquisitions

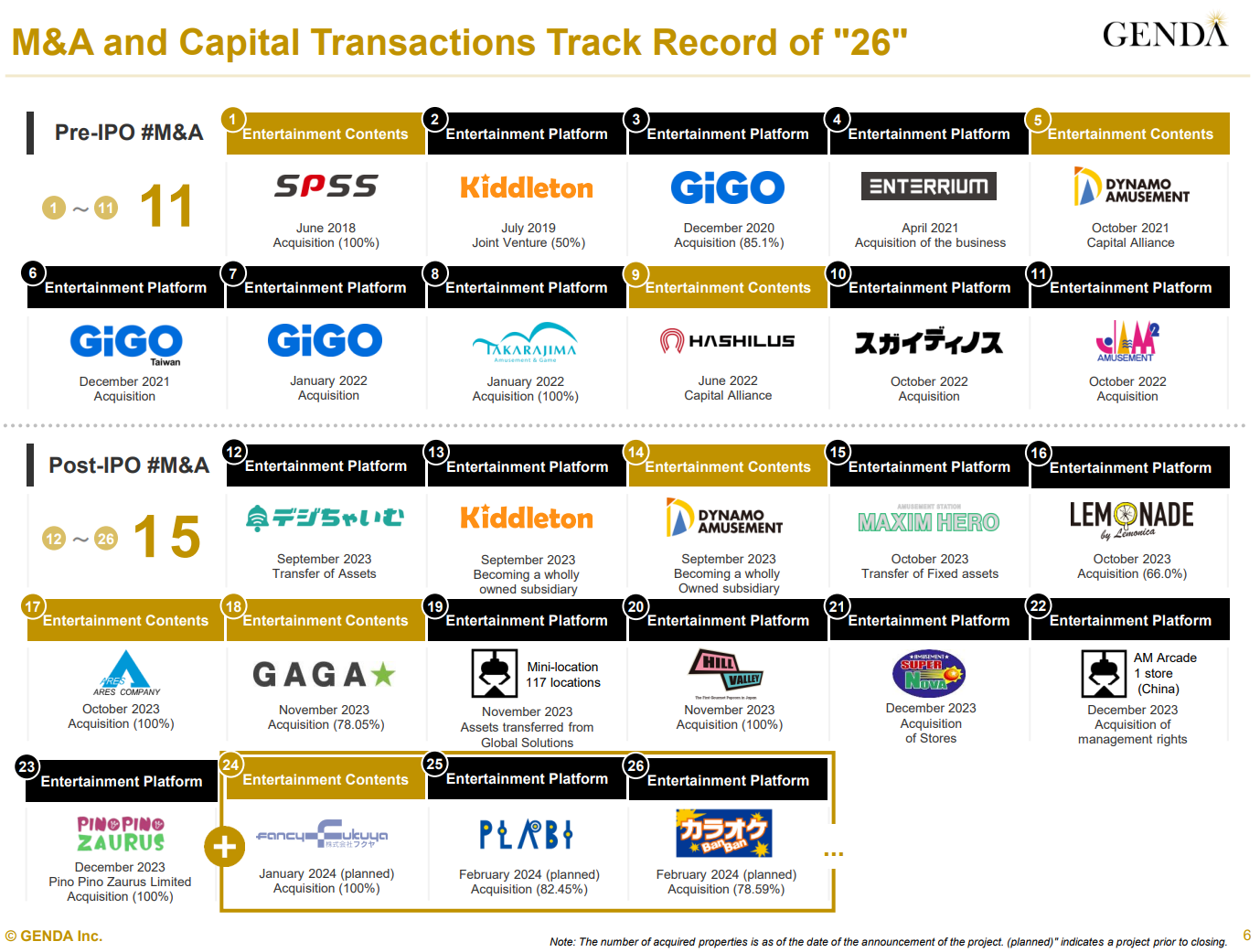

As briefly touched upon in Part 1, Genda made 26 acquisitions in its short life since its founding. 15 of which came in the last 6 months!

It’s public information that they sourced 102 acquisition targets in 2023 and made 15 acquisitions so that’s a hit rate of 14.7%. This pace may be a little worrying but many of these were small in size (faster to close) with existing relationships. In preparation for the IPO, GENDA could not do any M&A, and seems they worked through that backlog. As a result, I think the acquisition pace will slow from here.

Since its founding, the largest acquisitions among them so far have been: Sega, PLABI, and Shin Corporation.

Sega was the pivotal moment for Genda which set them on the path to establish a platform as a true roll-up. Given the relative size back then this required some equity financing from its backers. Sega arcades were run sub-optimally, and whilst management doesn’t like talking about PMI you have to give them credit, from 2019 to 2022 operating income from this division increased 2.7x.

Unlike Sega, PLABI and Shin Corporation, which both add substantial earnings to GENDA operation (along with Fukuya) were fully financed by debt.

Shin in particular was sizable adding 18 billion in revenues but operating margins only at 1%. This is its first large acquisition in the karaoke market adding 372 new locations to Genda’s footprint. It’s the 3rd largest player by store count. The karaoke market was impacted heavily by covid through 23 and earnings are still depressed. This will be one to watch carefully given that it is essentially a new vertical and we’re yet to see what the synergies are. The TAM for karaoke is roughly 300 billion JPY compared to 540 billion for the amusement arcade market.

Margins for this industry are lower. Shidax for example reported operating margins of 3.2%, which is not bad per se and management doesn’t mind either - Genda is focusing on making acquisitions where they can get high cash on cash returns regardless of margins.

Financing

One of the key bets that Genda is making is capitalizing on its ability to make low multiple acquisitions with low-cost debt = High IRR.

So it’s a pre-requisite that Genda has the right banking partners. In their case, they have a partnership with 30+ banks for Acquisition financing. Given the relative scarcity of this type of strategy and the Bank’s hunger for yield, they are falling over each other to work with the company. In theory, this puts Genda in a position to receive highly favorable terms.

This helps in two ways: banks competing over Genda leads to better terms both in terms of interest rates and absolute value i.e. Loan to value (LTV). Currently, Genda is paying interest of 1-1.5% and fixed for 5 years but is in a position to pay sub-1 % rates if they wish. What management is open about though, and I think is fair, is that they prefer to pay a ‘fair’ rate and prioritize good banking relationships rather than squeeze them.

I like this type of attitude, they could get a few basis points more today, but choose to prioritize a good relationship for a potential storm tomorrow.

And the LTV they can get out for these acquisitions is quite high. Genda spent 1.8 billion JPY of Non-Debt financed Cash to acquire 4.5 billion of EBITDA. If we assume the acquisitions on average were somewhere in the range of 3-5x EBITDA that’s an LTV ratio of 87 to 92%.

As mentioned earlier what’s remarkable is that its 3 most recent acquisitions, which added about +34% of EBITDA on top of projected full-year EBITDA for January 2024 were entirely financed by debt. Despite the meaningful size.

I would note that they don’t disclose the price tags of these acquisitions. Which is a negative. Could they be overpaying for acquisitions? Maybe. It could also be that they don’t want to publicly disclose that they’re making acquisitions at low to mid-single-digit multiples of cash flow… I’m willing to bet on the latter. They have said that for the first 12 acquisitions post IPO (i.e. excluding the most recent 3). Average multiple paid was 3.5x EBITDA before any synergies.

Note that after 62% incremental growth in EBITDA from acquisitions after IPO, its Net Debt/EBITDA still only stands at 1.5x. This is ultimately a function of both its ability to acquire businesses at low multiples and being ability to pay down debt quickly thanks to its focus on cash-flow generative businesses.

Management tentatively sees the upper limit at 2.5-3 times Net Debt to EBITDA which temporarily may be exceeded upon closing a larger transaction – which they seem to be preparing for this year. They recently announced a revolving credit facility for 10 billion JPY and have explicitly mentioned their wish to make a large acquisition in a Q&A. This could become a catalyst for the stock.

Valuation

Given that the opportunity set is not as obvious at the prices today, I will only go over this briefly.

Genda trades at 11x EBITDA based on forward guidance which only includes the M&A completed. EBITDA multiple is a little tricky because it includes goodwill amortization (they use J-GAAP accounting) but also depreciation of arcade machines which is a real cost. Management states that EBITDA to FCF conversion is around 50% after maintenance capex (30% of EBITDA) and Growth Capex (remaining). So at a ‘steady state’ conversion is closer to 70%.

So current FCF/EV yield (including growth capex) is about 4-5% which doesn’t look cheap but not overly expensive. However, guidance for 2024 looks quite conservative if you consider they’ve only assumed revenue accretion from M&A they’ve already done and 0% organic growth from existing operations, which seems unlikely.

As we talked about in Part 1, some of its acquisitions are already seeing topline acceleration after joining Genda. With managers who were heads of its largest competitors running some of these divisions, it’s difficult to envision 0% growth. As of Q3 in fact, they report SSS of +9% for the first 9 months. Moreover, they also intend to open stores organically (roughly 10 a year) so that should also contribute.

With a high fixed cost ratio for this business (roughly 70% of the cost base, mainly labor, leases, and depreciation) - if we see growth in same-store sales this directly translates to operating leverage. Genda believes a 2-3% organic growth on a per-store basis can lead to double-digit profit growth as a result. In addition to that, I do believe there will be loose synergies across its portfolio. There are likely some economies of scale when procuring game machines, IP licensing, and financing which they’re already starting to see.

A point to be careful of is that the licensing fees it pays for some of its games in its arcades are set to increase this year. This is due to a normalization in pricing of some games it licenses from SegaSammy via its .net service which will offset profit growth from existing operations. During Covid (when outdoor activity was limited) SegaSammy agreed to provide a discounted licensing fee for in-store games. Hence why management wants to be conservative on OP guidance from existing operations and expects flat growth. Also, the reality is that the acquisitions don’t have as high a profitability as Genda so this is also likely to be dilutive at least in the short term. Though on a longer time horizon cost efficiencies can likely be realized and think profit growth can exceed topline growth.

There’s some growth optionality too: Inbound tourism constitutes about 5% of sales according to Genda, with an anime boom and tourism closing in on the previous peak in 2019, this could become a growth pillar that is currently not accounted for. Going to an amusement arcade in Japan is not quite the same as the ones that you see abroad and is a unique experience.

Secondly, the company is trying to expand its amusement arcade business abroad. The market for this is still smaller but with the anime tailwinds, this may also become a meaningful market. Today they have operations abroad via its Kiddleton brand, which opens ‘mini-sites’ that are unmanned, across the US. Due to the small sizes, revenues aren’t that meaningful but are reporting very short payback periods of less than a year (that’s >100%+ IRR). Worth mentioning again that the management team of Genda, in their previous jobs in competitor brands have experience in overseas expansion and they see the US as their core focus overseas.

So overall estimating a 12-month forward FCF yield between 4-5% will likely be too conservative if you include some profit growth from existing operations over time. Add some accretive M&A acquiring cash flow well above the cost of capital and it may end up looking much cheaper.

From another angle, forward EBITDA for Genda is at a premium compared to peers like Round One which trades at around 5.5x EBITDA. However, there’s a case to be made that Round One is also cheap (A great analysis by Alan from Continuous Compounding on them).

The main difference is that Genda is a Roll-up story and if you look at some of the existing roll-ups in Japan, like SHIFT, Japan Elevator Services, or Yoshimura Food Holdings they trade at a significant premium to Genda - all above 20x EBITDA.

I don’t know if and when that gap may narrow, but a potential catalyst could be a re-listing from the TSE growth market to TSE Prime at some point, which makes Genda more ‘investible’ by institutional investors. To be clear, there are still some hurdles for eligibility.

ESG discount: Agree or disagree with the principles of ESG, but there could be a discount on the stock as a result of it being in a somewhat dubious sector. Genda has also opened poker rooms.

Key Risks:

Sustainability of acquisitions: like with any serial acquirer how sustainable is the growth for this kind of business?

As the company scales over time the opportunity set will shrink because targets will have to be larger and there will be a natural downward pressure on IRR. I’m not counting on this to be a CSU that can replicate smaller acquisitions seemingly ad infinitum. So whilst the addressable market for Amusement arcades might be 540 billion JPY, assuming that their strict investment criteria are true, realistically only a portion will be acquirable.

As an offsetting factor though, Genda seems to be finding complementary verticals to Game arcades like Karaoke and future expansion could lead to a much larger TAM. IP content, which is one of their main 2 pillars today seems like a very interesting opportunity to make highly scalable acquisitions too.

The other risk here is that owners may not be willing to sell their business – Japan is slowly becoming comfortable with M&A but many owners still don’t fully understand what that is and may be reluctant, believe or not.

Interest Rate Risk: Much of its acquisition strategy will hinge on the idea that interest rates remain low. There is some wiggle room and Genda believes they can comfortably make acquisitions even at yields being 2.5% (versus 1-1.5% today) but beyond that acquisitions may get trickier as the IRR you get will not be as good. With so many banks trying to finance Genda though they have some scale benefits and can get above-average terms. On existing debt, however, interest rate risk is low given it is mostly fixed for about 5 years and the company is actively paying down debt with the cashflow it generates.

Execution: this will always be a risk both in executing acquisitions and for expanding operations and the market may discount management until they have shown a track record. As I’ve highlighted many times though, it’s remarkable to have such an experienced management team that handles day-to-day operations, which hedges the risk of mis-execution. Of course, they could still drop the ball if they expand into verticals that they aren’t too familiar with like Karaoke.

Increased competition: There’s a pretty good case for why Genda is the acquirer of choice (Discussed in part 1) and this is an even easier proposition because none of its main competitors are doing any M&A. Because they are smaller divisions of a larger enterprise there are less incentives and resources directed. If that changes however and they adopt a similar M&A strategy this could potentially lead to bidding up of acquisition multiples.

Cycles: We are yet to see if this business is going to be cyclical or not. The idea that the business will not be impacted because it’s such a ‘cheap’ form of entertainment that customers are unlikely to spend less on it sounds somewhat plausible but hard to tell. If you look at the past the prize game market was relatively flat between the periods 2008-2013. However, if you looked at what SegaSammy reported during that period, same-store sales growth declined by 15-20% during that period.

Stock Overhang: One of the early funders of Genda is Midas Capital (run by serial entrepreneur and founder of airtrip) which through two entities owns close to 43%. Particularly Midas G owns 5% which is an LP fund and may look to exit at some point. Management has mentioned in this event they would consider a block trade.

In conclusion

Unfortunately, the stock moved up quickly over the past months. Whilst I argue that it isn’t expensive today, it’s not a one-foot hurdle either and the risk/reward is not as asymmetrical. Given that the business itself is relatively young, the absolute downside, if it goes wrong, can also be large (no matter how asymmetrical the risk-reward is) and makes it harder to justify a large weight in a portfolio. I researched this name precisely because I got mixed reviews from some of my peers- investors who are much more intelligent than I am. It’s a sufficiently quirky business and I found it crazy the fact that Genda’s management includes some top execs who jumped ship from 3 of its 4 main competitors. Not to mention top management has significant skin in the game. I still have a small position and will be watching this one with interest, given it’s one of the early attempts of a roll-up in Japan (Besides SHIFT) with increasing institutional coverage it will be interesting to see how the market will value this opportunity. A short-term catalyst I expect is the announcement of a sizable acquisition, which could grow FCF meaningfully.

Thematically this is also an interesting play to unlock some of the value that’s been trapped in profitable and cheap privately owned businesses in Japan that are likely going to see a wave of succession.

One more thing… I got multiple feedbacks that Genda is overly promotional. This is a fair point. They’ve committed some chart crimes if you look at their presentation and I’m not a fan when companies show +24% growth as 124%. Having said that, so far the company has not over-promised in any way in terms of their financial goals. They deliberately avoid giving out a Mid-term goal because this incentivizes them to make the wrong acquisitions to meet them.

In the end, good investor relations capability cuts both ways – if they’re good at disclosing information to shareholders this can be seen as overly promotional. Though I’ve quite enjoyed them releasing a monthly FAQ which few companies do – and this has helped clear some of my previous doubts. Otherwise, their execution has been so far so good – for now. It is too early to decide whether this is truly an exceptional management team (as many others probably also feel) and will leave that up to you.

Thanks again for your time, hope to be sharing more ideas with you soon!

Disclosure: the writer currently owns shares in the company as of 6 March 2024. The security could be sold at any point in time without any disclosure.

Disclaimer: The content on this website is for informational and educational purposes only. Nothing should be considered as investment advice or as a guarantee of profit. Please make sure to do your due diligence when making investment decisions.